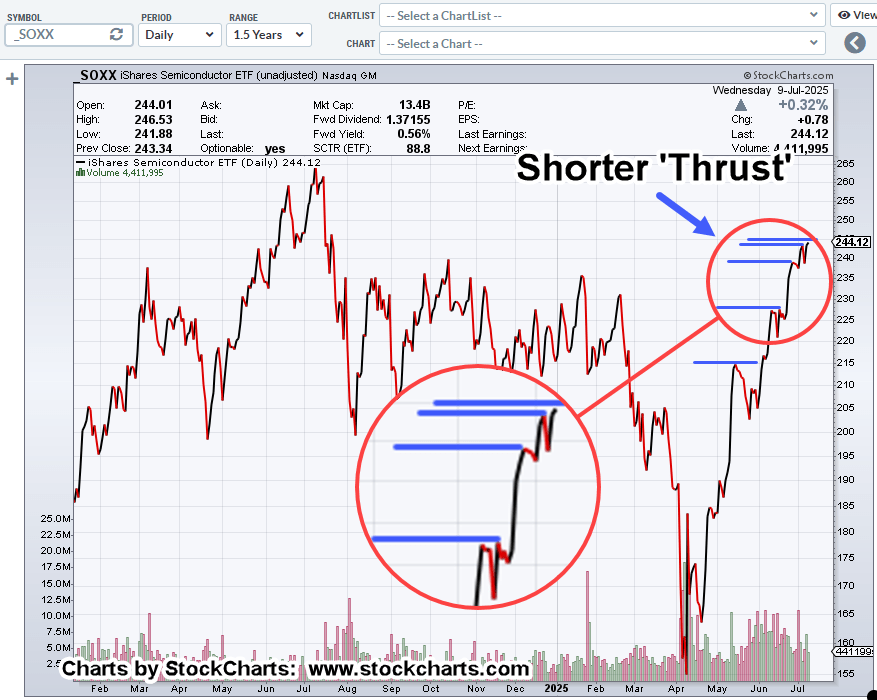

Thrust Apex?

From the April 7th lows, to now, each successive move higher in the SOXX, has traveled less net distance.

In Wyckoff terms, this type of market behavior occurs near the end of a move (not advice, not a recommendation).

Let’s not forget the up-thrust condition, still in effect, discussed here.

Semiconductors SOXX, Daily Close

In a related analysis, the last post on Nvidia had it at Fibonacci Week 144 (-1).

Now, a week later, Nvidia is in Fibonacci Week 144 (from October 2022, lows), posting all-time highs.

Positioning

Short the SOXX, as trade SOXX-25-03, with stop just above the session high (not advice, not a recommendation).

Note: This could be a very short-lived trade as SOXX, is trading higher in the pre-market (as of 8:35 a.m., EST).

Separately, the stop on short trade WMT-25-04, has been moved down to just above its session high at 97.31 (not advice, not a recommendation).

If WMT, posts a new daily high, it’s likely to test the trend break; we’ll stand on the sidelines if/when, that happens.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Nvidia, Down Early Session « The Danger Point®