The Big One?

It’s been a long time coming.

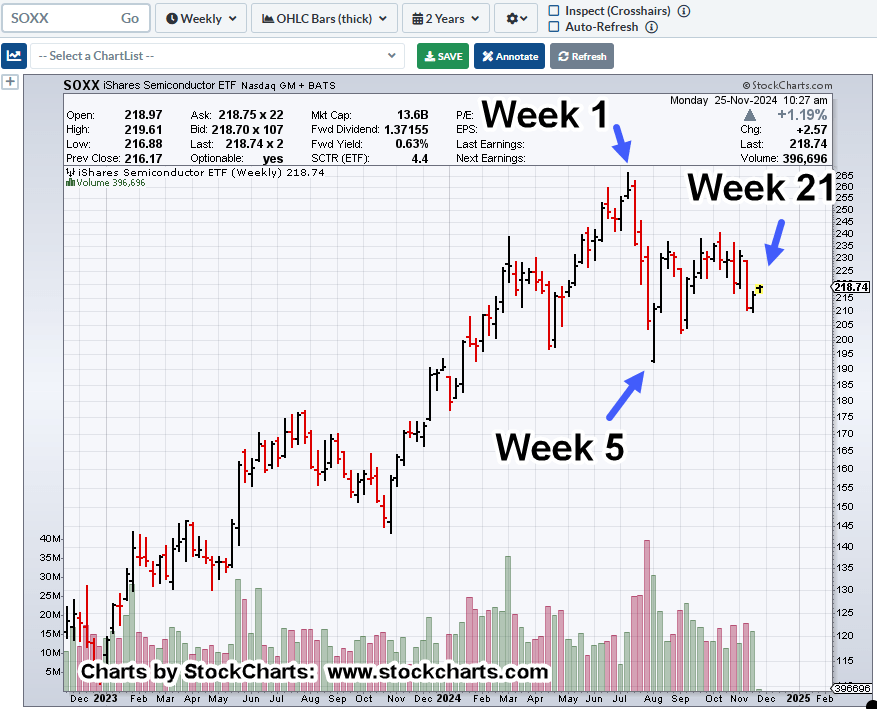

The next down-leg in the SOXX, and A.I., bubble, may be at hand (not advice, not a recommendation).

Many factors coming together; Fibonacci projections, retrace levels and time sequences; price action posting and defining trend lines and trading channels.

With that, let’s take a look at what the SOXX, is saying about itself.

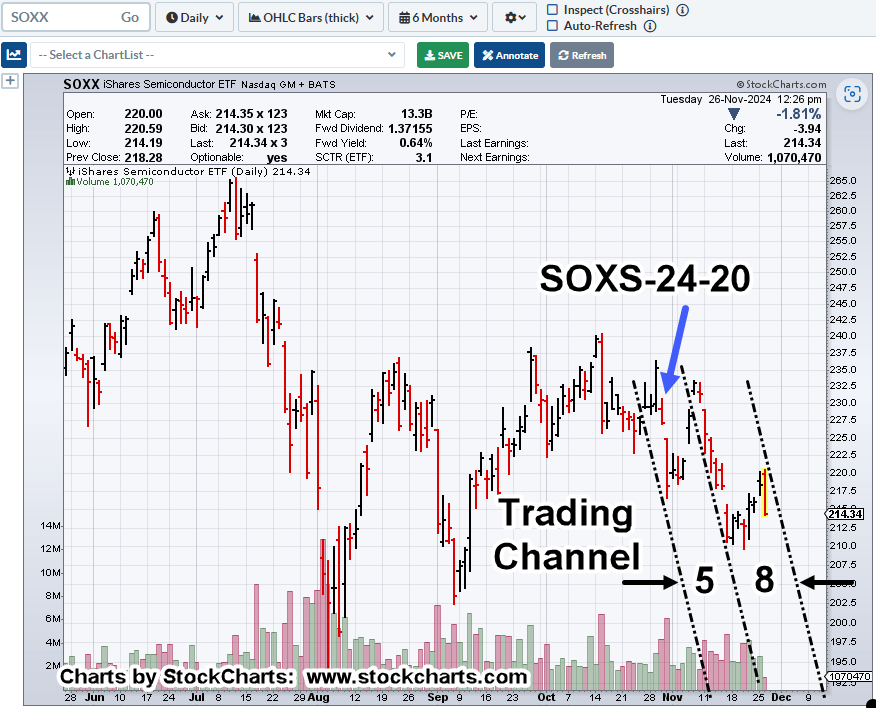

Semiconductors SOXX, Daily

We’re half-way though today’s session, anything can happen. Even so, the test and reversal are clear.

What also may be in the making, is the verification of the trading channel shown.

The channel has its own Fibonacci count(s).

One part, Fibonacci 5-days wide, another, Fibonacci 8 days, for a total of Fibonacci 13-days.

Positioning

For those following this site on a daily basis, you already know, this sector’s been sold (short) via leveraged inverse fund SOXS (not advice, not a recommendation).

Trade number is, SOXS-24-20, in the sidebar, above.

The short was initiated with this update, shown above in the chart. It was maintained throughout the gyrations of the ‘election’ and aftermath.

Now, we wait.

If nothing else, and the trade falls apart, today’s session high in the SOXX, is an excellent place for a stop (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279