Gold Bulls Exhausted

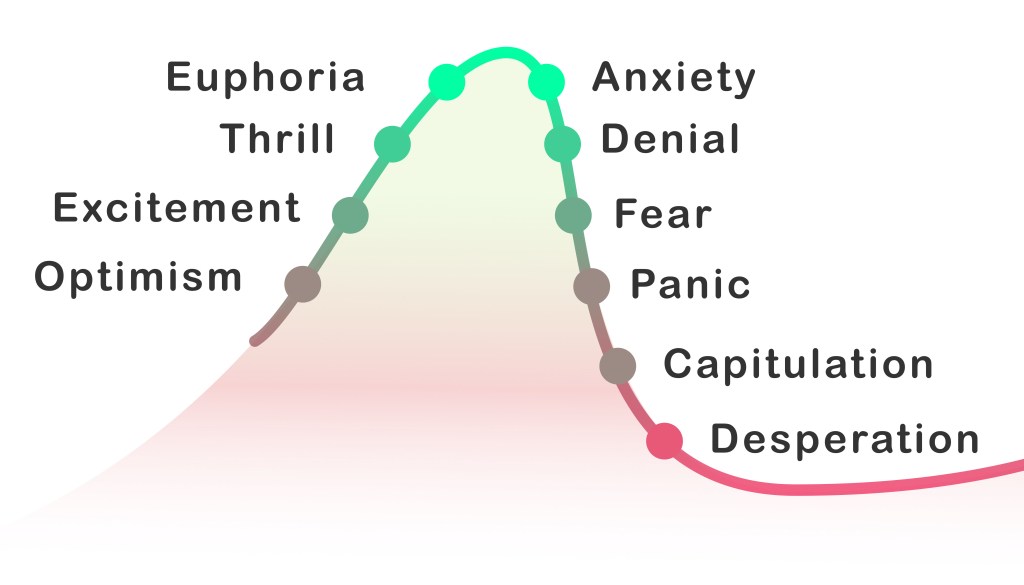

With Friday’s downside reversal we’re now between Euphoria and Anxiety for gold.

This past week was inundated with stories of panic at the bullion dealers.

YouTube ‘content creators’ were going berserk with hyper-inflationist rants; other ‘influencers’ telling us the dollar’s about to collapse; they say the Fed’s the only reason the dollar’s not at zero right now.

Then, rumors warning of gold to $5,000/oz. and higher.

The result as you would expect, is a highly emotional, manipulated public.

Different This Time?

At this point, whether or not the dollar will collapse is probably irrelevant.

Long time visitors to this site already know, battle lines (like here and here) are being drawn and it’s not in precious metals (not advice, not a recommendation).

As always, anything can happen and gold could go higher but with Friday’s reversal, probabilities have now shifted to the downside.

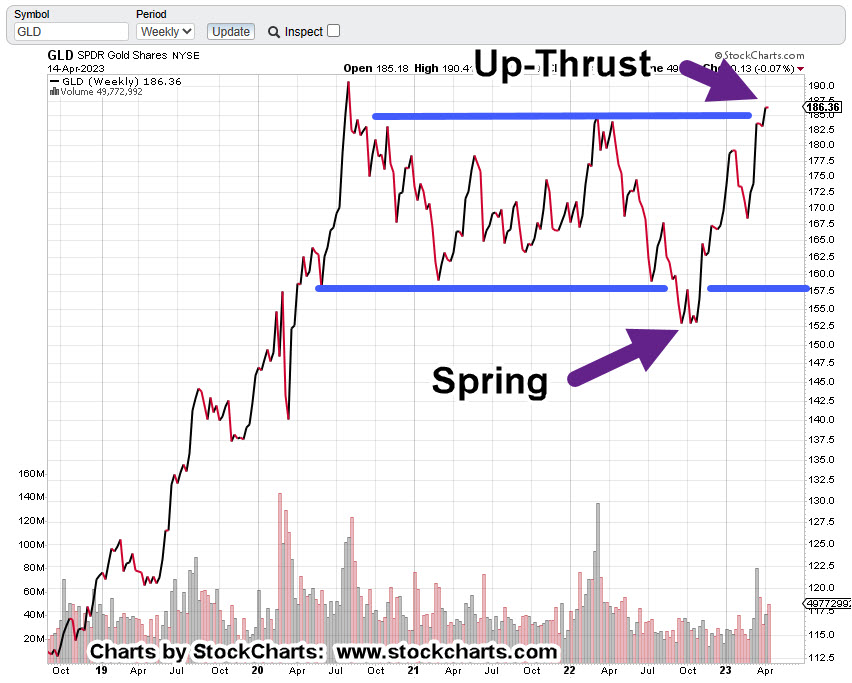

With that, we now have an ominous chart of gold below.

It shows the set-up to a repeating market characteristic:

Wyckoff ‘Spring to Up-Thrust’.

Gold (GLD) Weekly Close

Gold’s momentum wanes just as it’s pushing up through resistance.

Obviously, what happens next is the important part.

Strategy

Looking at the economic calendar for the coming week, there’s a Fed speaker every single day. If we’re really at a significant reversal, next week’s likely to put the panic into unsustainable overdrive and mark the top.

For the bulls, we’re looking for the GLD, highs to be maintained. If it can’t hold, there’s reversal trouble ahead.

A Reversal?

If this is the ‘big one’ and gold reverses, a likely (medium-term) target is in the area of $1,300/oz., – $1,350/oz. (not advice, not a recommendation).

If that happens, gold’s still expensive but it’s the mining sector GDX, GDXJ, that would potentially be devastated.

Both the Seniors and Juniors are already printing an MACD bearish divergence (not yet confirmed) when looking at the weekly charts.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Gold Miners … The Reversal « The Danger Point®

Pingback: Miner’s Reversal … Still Early « The Danger Point®

Pingback: Gold Miners … Too Late To Short ? « The Danger Point®