At The Next Open

If we’re at the downside pivot for gold and the miners, there’s only one right answer for the next market session.

That answer is:

Lower open, lower high, lower close.

Not advice, not a recommendation.

However, it is an assessment of where we are in the market cycle for gold and the miners.

The focus is on the Juniors GDXJ, as they are the weakest of both gold GLD, and the Seniors GDX.

If GDXJ, does not open lower, there’s something else happening; that would mean the downside reversal potential is in question and/or it could morph into more testing at the Axis Line, previously discussed.

Here’s a close-up of the sector.

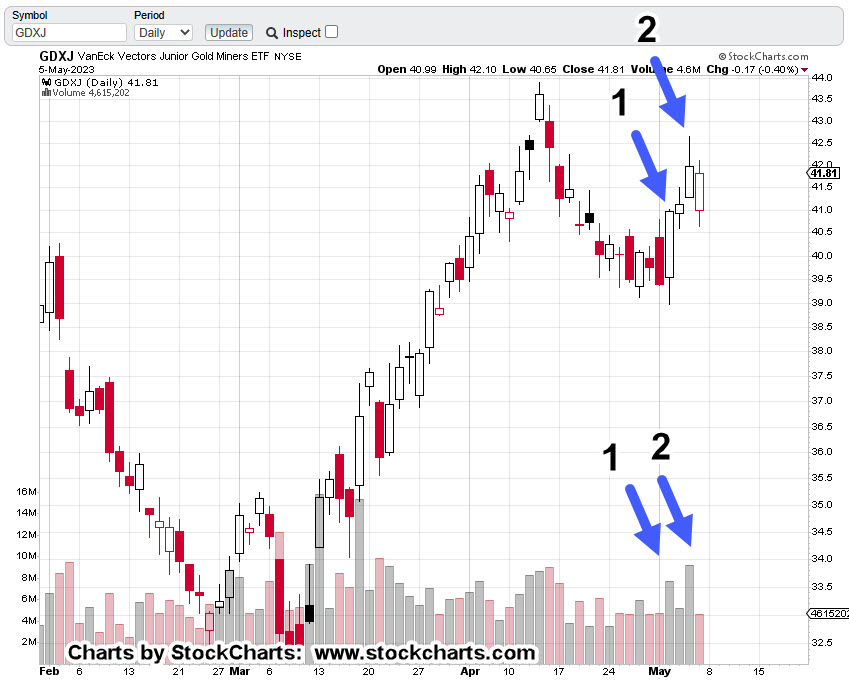

Junior Miners GDXJ, Daily

Volume bar No. 1, corresponded with a solid up move for that session; shown as Price Bar No. 1.

Volume Bar No. 2, is where it gets interesting.

Specifically, higher volume, more narrow range (net distance) and a close well off the high.

Wyckoff called this: ‘effort vs. reward’.

Lots of effort (volume) with less reward (distance) than the previous move.

The next session confirmed that assessment by opening gap-down and then spending the entire day attempting to close higher … which did not happen.

That day (last Friday) may have been short covering. If so, we’re about to find out.

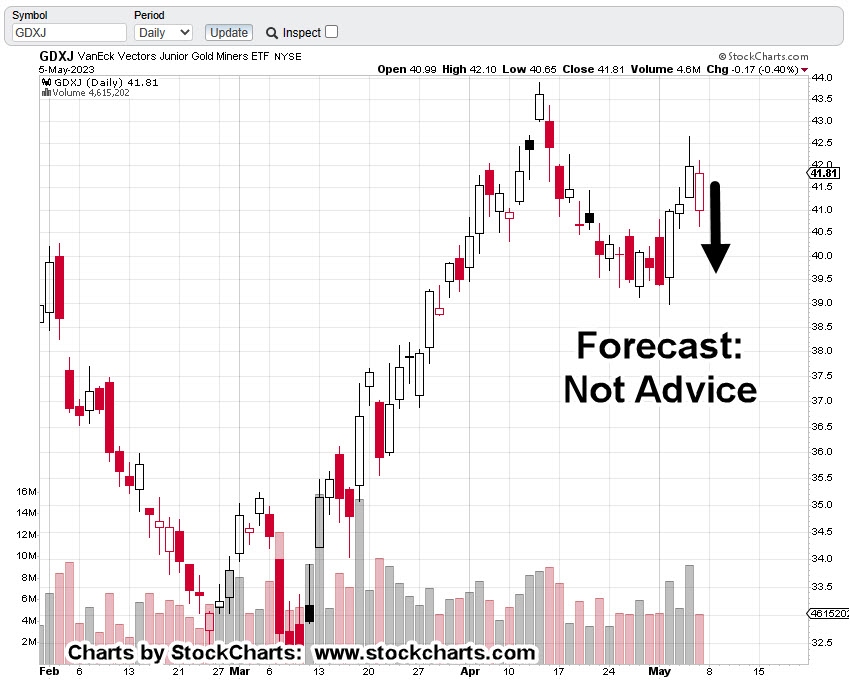

Junior Miners, GDXJ, Daily (forecast)

If we’re in a reversal (a big if), then we’ll get some variation of the price bar (black arrow) as shown (not advice, not a recommendation).

For the bearish option to remain intact, GDXJ needs to open lower and close lower for the day.

However, it does not need to post a new daily low, although that would help the case for more downside.

Anything other than what’s just described, would indicate a more complex price action environment.

If that happens, an update will be released.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Gold Miners … Test & Reverse « The Danger Point®

Pingback: Miner’s Reversal … Still Early « The Danger Point®

Pingback: Kabuki ‘Debt Ceiling’, & Gold « The Danger Point®

Pingback: Kabuki ‘Debt Ceiling’, & Gold — The Danger Point® – The Fourth Estate

Pingback: Gold Miners … Too Late To Short ? « The Danger Point®