Frustration Enough To Pull Your Hair Out

If it’s frustrating for the bears, it’s got to be frustrating for the bulls as well.

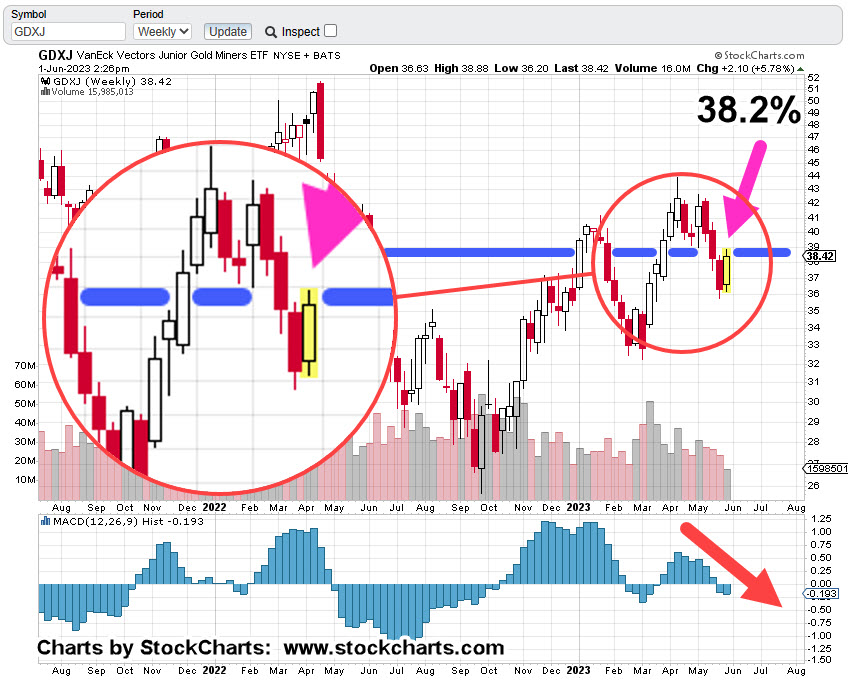

Pulling back and looking at GDXJ action without emotion, it’s clear we’re still in the ‘test’ (as we’ll see below) that’s been the topic of discussion over the past several updates.

The weekly chart of GDXJ, shows that even with today’s (as of 3:04 p.m., EST) retrace and test, we’re still in a negative divergence on the MACD (orange arrow).

Junior Miners GDXJ, Weekly

The horizontal blue line is not only an axis/resistance line, it’s also the Fibonacci 38.2% retrace of the GDXJ down move, April 13th, to May 25th.

We’re about an hour before the close and price action’s starting to erode from the highs.

If the downtrend is to continue, this may be a low-risk area for the shorts via JDST (not advice, not recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279