Lots of Volume … Little Progress

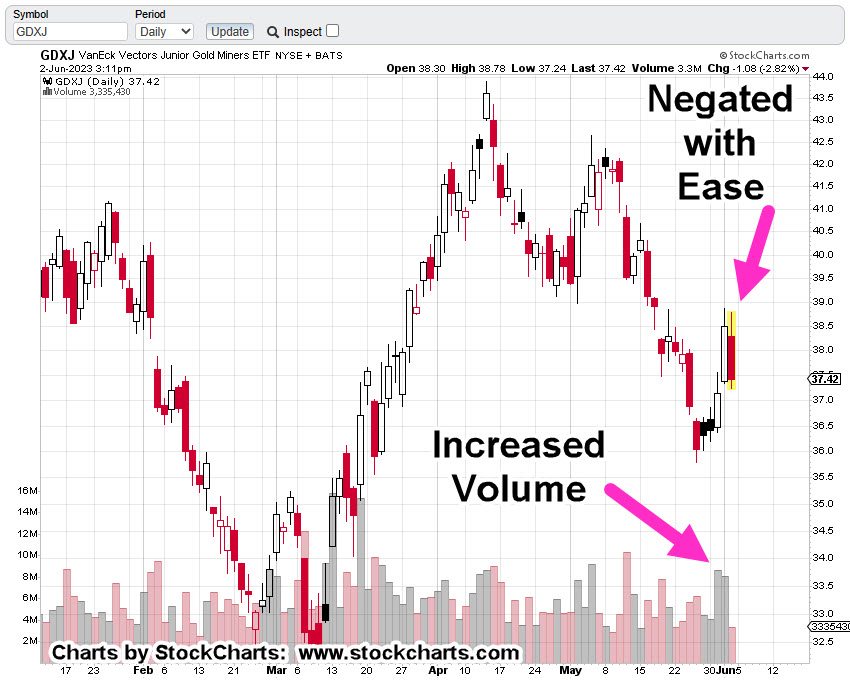

For the past two days Junior Miners GDXJ, launched higher on increased volume and then whacked itself right into resistance.

The daily chart shows the heavy up-volume, relatively wide price bars and then today’s decline (and new daily low) that took place with ease.

Wyckoff called this, ‘effort vs. reward’; lots of upward thrust (volume) that so far, can’t hold.

We’re about thirty minutes before the close and anything can happen; with that said, GDXJ is on track to close near the lows of the day.

Junior Miners GDXJ, Daily Candle

The ‘Inverse’ Clues

While the GDXJ, was declining with apparent ease, interesting things were happening with the leveraged inverse fund JDST.

That is, huge block trades were posted on the tape.

At least two blocks of 150,000 shares were observed scrolling on the tape within seconds of each other.

At the executed trade price, 150,000 shares represent a commitment of $972,000

Two of them is $1.94-million; a ‘modest’ position. 🙂

It should be noted that yesterday’s volume in JDST, was the second highest (edit … 4th, highest), ever.

In addition, those block trades mentioned above, took place in the middle of the day … highly unusual.

It all could be a ruse or for real. Either way, something big may be about to happen (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279