Classic, Textbook

It’s rare to get a ‘textbook’ signal … but every now and then, it does happen.

The last update on the Junior Miners, GDXJ, said a short position in the sector was re-established.

Today’s trading action may be straightforward; we either get stopped-out, or the market gives the signal to enter a full (sized) position (not advice, not a recommendation).

The bearish case for the miners has already been established many times over. Recent posts are here, here, here and here.

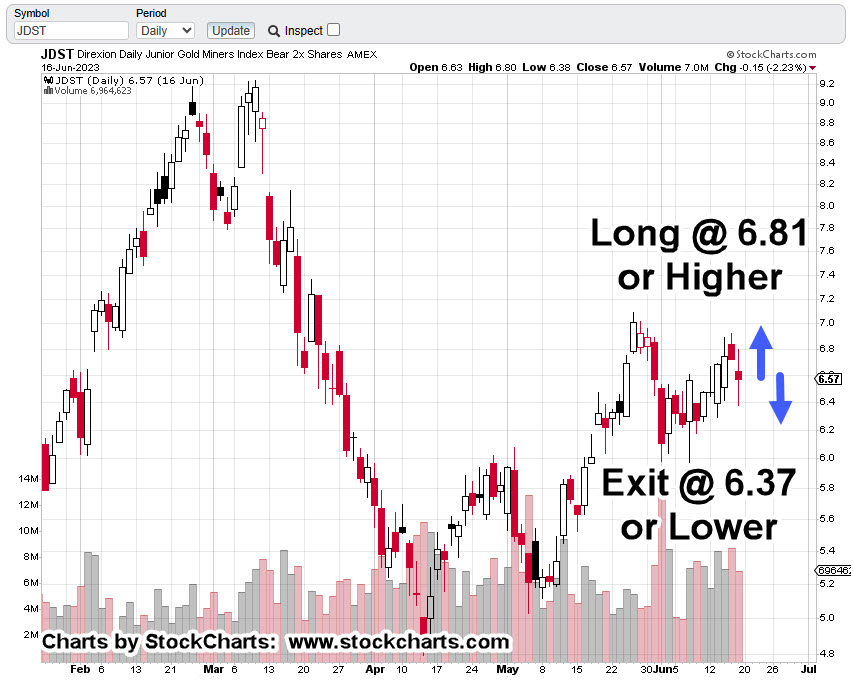

Since we’re looking at the sector from the short side, we’ll use the chart for the leveraged inverse fund JDST.

Junior Miners, Leveraged Inverse JDST, Daily

As said at the top, it’s (potentially) straightforward.

If JDST, price action exceeds 6.81, a full position will be entered with hard stop at this session’s low (determined at the close of the day).

If price action declines to 6.37, or lower, the existing (small) position is closed out.

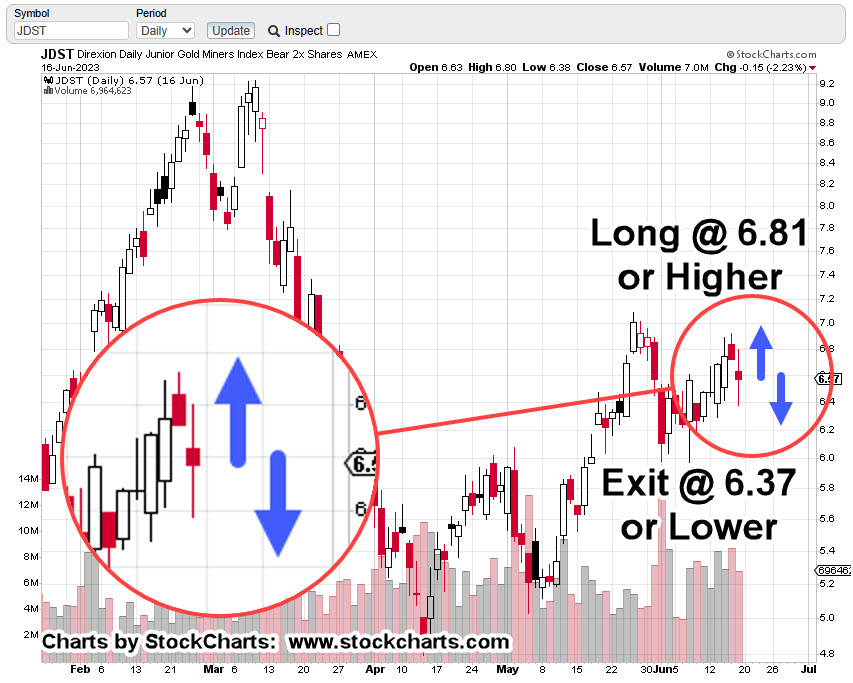

Closer in, with a zoom of the price action.

As of this post (8:41 a.m., EST) JDST is trading in the pre-market slightly higher at, 6.65 which is + 0.08, or + 1.22%.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Mind The (Miner) Gap « The Danger Point®