First of Many?

At this point, market bulls have to be just a little bit nervous.

Is the reversal from Friday, going to hold into next week or was it just a blip on the way to much lower levels?

Can a ‘Once in 300-years mania’, affect us here and now. Is that knowledge useful for day-to-day decisions?

One way to answer is to place that fact in the ‘fundamentals’ category; knowing it’s there but stay absolutely focused on the immediate truth, that is, ‘price action’.

The SOXX, So Far

We can see the SOXX reversed as identified here.

Then it continued lower, formed a trend line, shown here (using inverse SOXS).

Fast forward to now.

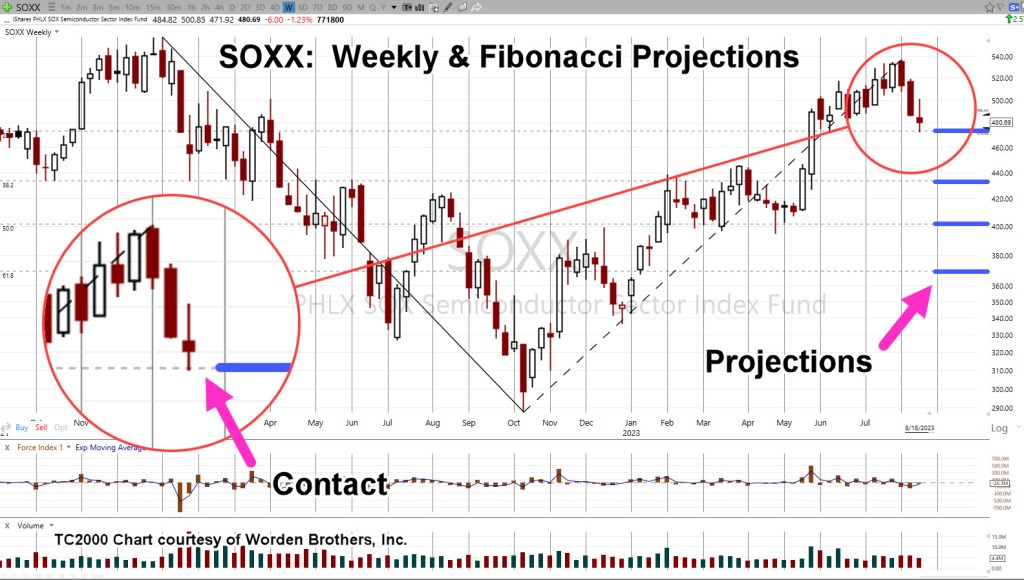

The weekly chart (below) shows price action contacted the first Fibonacci projection ‘exactly’ and rebounded.

That ‘rebound’ was Friday’s reversal bar.

Semiconductor SOXX, Weekly Candle

We’re at a critical juncture.

Livermore said years ago, ‘surprises tend to come in the direction of trend’.

With that, Google may have just released the first of many AI, and specifically NVDA, market surprises.

That report is the for the mainstream and even it admits, ‘There was a lot of hype’.

When hype is exposed, the market typically exacts its own form of revenge.

That revenge usually falls on the ‘little guy’ who’s left holding the bag, unable to fathom, ‘the experts’ were only in it for the money.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279