Then, The Real Estate Bubble

The elephant in the room:

Rates are not going lower, they’re going higher; sooner rather than later (not advice, not a recommendation).

Yesterday, ZeroHedge reported the 5-yr auction was nasty with rates rising to near recent highs.

Today, we have yet another supply disruption impacting so-called ‘inflation’.

Couple that with an apparent real estate implosion.

DH Horton (DHI) down nearly – 12% in just days and holding steady in the pre-market session.

It looks like the bubble party is (finally) over.

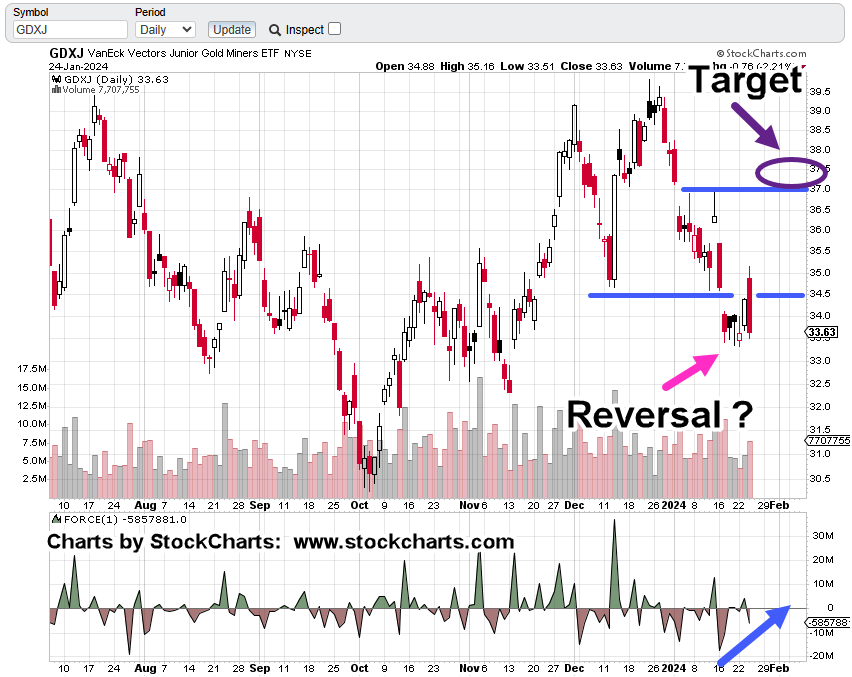

Gold Miners To Catch Bid?

The miners are at another critical juncture.

The Juniors GDXJ, are up in the pre-market session (8:00 a.m., EST) and may be catching a flight-to-safety bid as parts of the markets top out and/or reverse.

That flight to safety may not last long as we’ll see below.

Junior Miners GDXJ, Daily

Trading is up about 1% or 0.32 pts in the pre-market.

GDXJ, price action is at The Danger Point®.

We are either in a reversal (Wyckoff spring) set-up or just a pause before posting lower.

If it’s a rally, the target area is shown (magenta oval); corresponding to a 61.8% retrace.

Stay Tuned

Charts by StockCharts

Pingback: Miners Break Down … Again « The Danger Point®