Ruh, Roh

The bond market’s reversed; rates are moving higher.

Real estate’s bid up as if rates are heading lower, not higher; what could go wrong?

It’s been seven consecutive lower closes (rates higher) in the bond market, TLT, starting before the Fed has its conference last Wednesday.

This morning, bonds, TLT have just posted another daily low; if it stays there, will make it a Fibonacci eight days of consecutive lower closes.

Let’s cut to the chase and go to real estate.

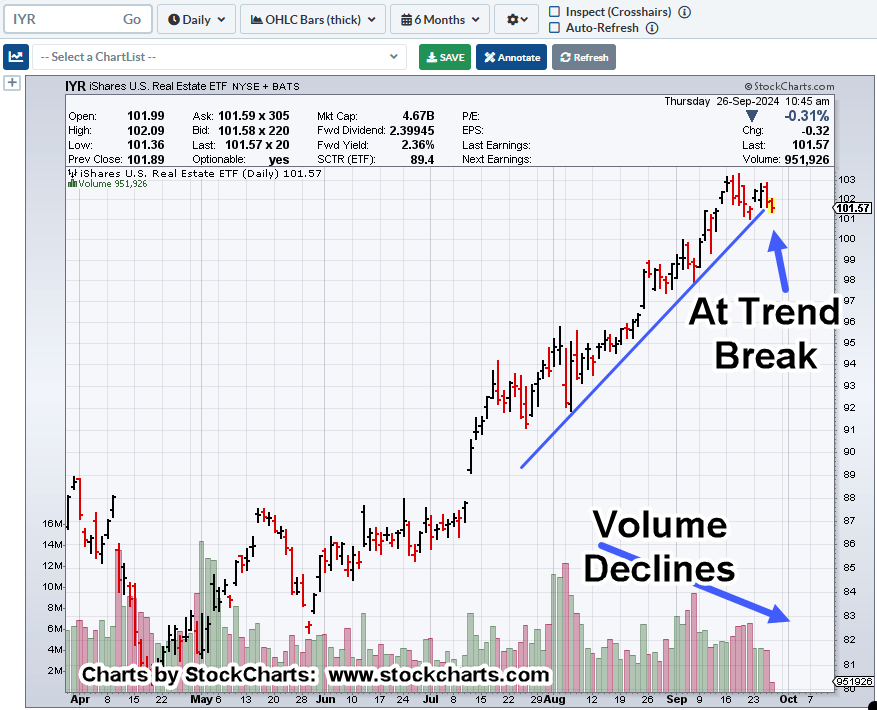

Real Estate IYR, Daily

We’re right at the trendline and threatening lower.

Declining volume implies the energy and commitment to higher prices is fading (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Real Estate Reversal « The Danger Point®

Pingback: Bonds … The October Surprise « The Danger Point®