Setting The Tone, For 2025?

The chess game continues.

If it really was as simple as ‘dollar collapse’ and ‘inflation’, why have the miners GDX, GDXJ, and SILJ, been in a bear market since 2011; fourteen years ago?

During that time, we’ve had rallies for sure. However, the fastest (major) moves with 2016, the exception, have been to the downside.

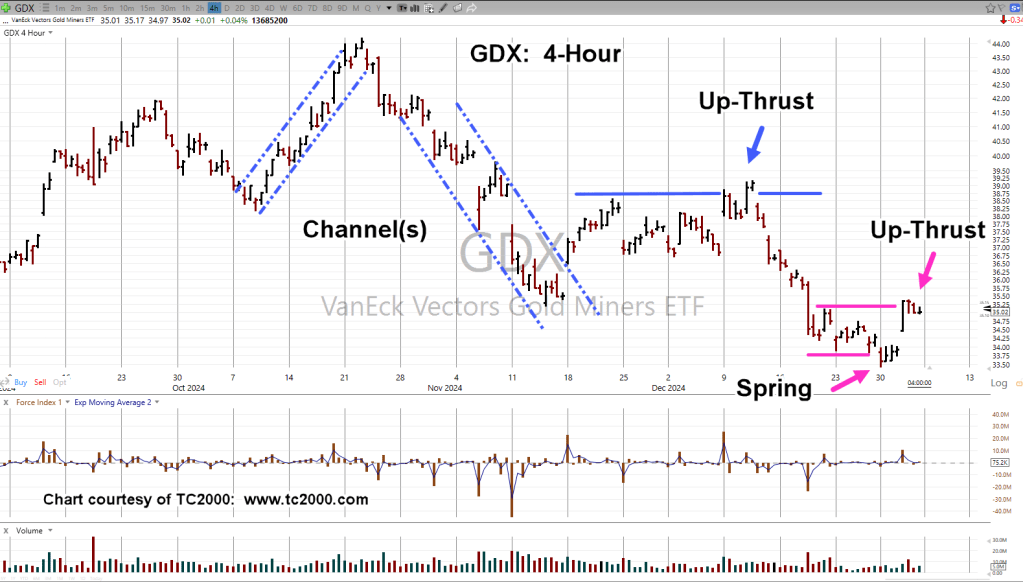

Drilling down a bit on Senior Miners GDX, we’ll look at the 4-Hour chart.

Senior Miners, GDX, 4-Hour

In the past three months, depending on one’s timeframe, there were trading opportunities both up and down.

With that said, we’re now at the far-right edge.

There’s a (potential) set-up: ‘Spring-to-Up-Thrust‘ (not advice, not a recommendation).

Positioning

As noted in yesterday’s update, right around mid-session, a short was opened: DUST-25-01 (not advice, not a recommendation).

Of course, the expectation is for GDX, to decline immediately from here (DUST, higher) at the next session.

Anything else, suggests a trade failure.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279