Reeling From The Hit

February 19th, after hours action, Carvana posted 310 as the high; then, three days later, the lows at 207.85:

That’s a direct hit of -33%

Then, incredibly, short interest does not increase but decreases (from just over 10%) to 7.8%; you can’t make this up.

Emotionally Exhausted:

If you’d been short this (vending machine) ‘disruptor’ for nigh on two years, as it rachets ever higher, and then it finally, breaks down … what would you do?

You’d probably be emotionally (maybe financially) exhausted, tired of watching the never-ending grind higher and cover (whatever’s left of) your shorts.

Wheels Off

As Hindenburg reports, Carvana has some interesting ‘fundamentals’.

With that, let’s look at the most likely area for a possible punch-drunk recovery top, and reversal (not advice, not a recommendation).

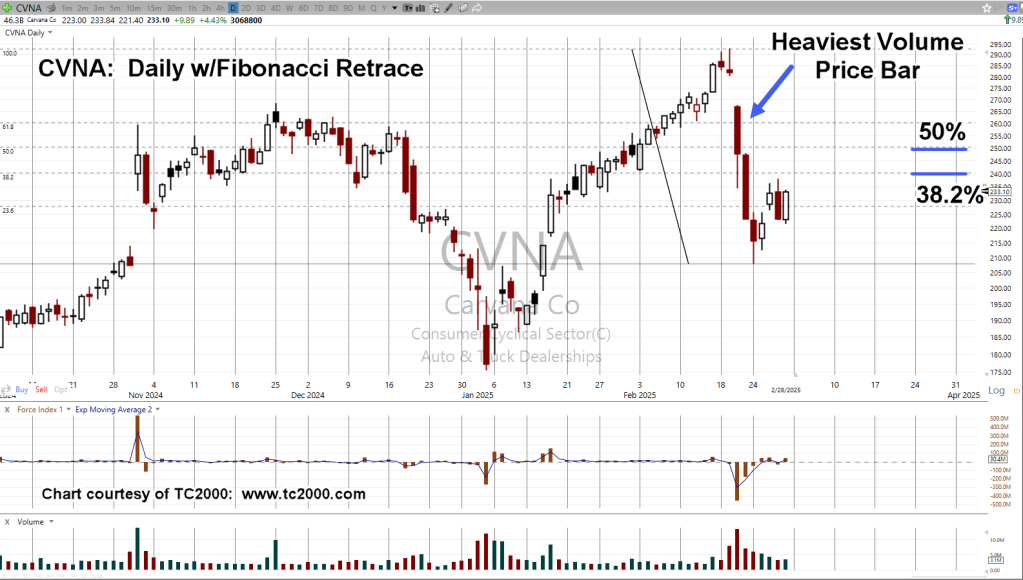

Carvana CVNA, Daily

The price bar with the heaviest volume was the day after the earnings release as shown.

That bar’s close is right around the 50% retrace.

However, if we extend the top of the retrace tool to start at the after-hours 310, mark (and not regular session high of 292.84), the 50% retrace now becomes the 38.2%.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279