Is This … ‘Inflation?‘

Is gold rising because of ‘inflation’ or just another market going through pattern-influenced moves?

Maybe there’s something else, something no-one talks about.

As far as known, the following insight (first discussed here) is exclusive:

Since 2020, world-wide gold output is declining; output for 2023, down over 9%, since 2019, link here.

Could this be a clue? Full article is here.

Well, enough of the truth.

Let’s get back to our fantasy world; the highly simplistic excuse that gold’s responding to ‘massive inflation’ and ‘money printing’.

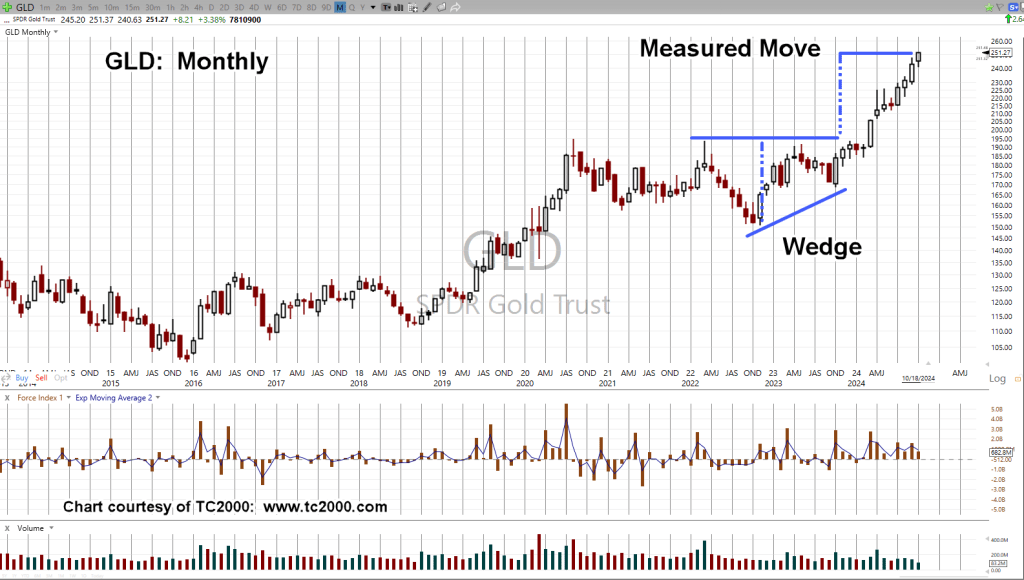

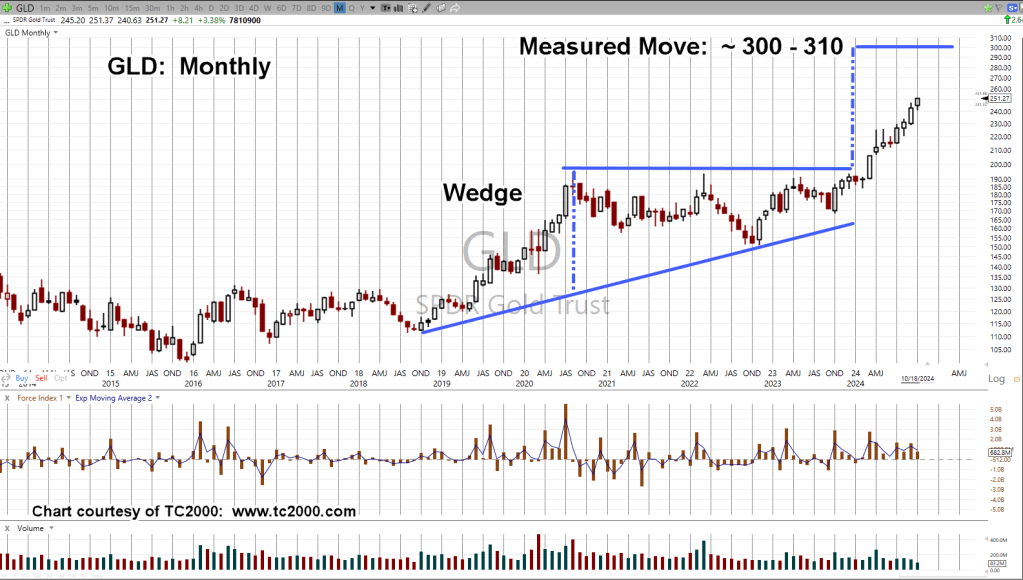

Gold GLD, Monthly

One wedge, with its target already reached.

There’s another potential wedge (not advice, not a recommendation).

Since futures are trading about $200/oz. higher than GLD (at 1/10 oz. pricing), the second measured move if reached, corresponds to about $3,300/oz. (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279