A Long Way To Go

If this is the ‘big one’ that everyone’s talking about, the miners have a long way to go to the downside (not advice, not a recommendation).

When there’s a viable, bearish (or bullish) divergence, then price action has the potential to go much farther and the move last much longer than anyone would expect.

Junior Miners GDXJ (as well as GDX), have posted a bearish MACD divergence on the weekly time frame … very significant.

That divergence is shown below:

Junior Miners GDXJ, Weekly Candle

Price action goes one way (i.e., up) while MACD goes the other … down.

Other posts have already covered details of the current set-up, now reversal, links here and here.

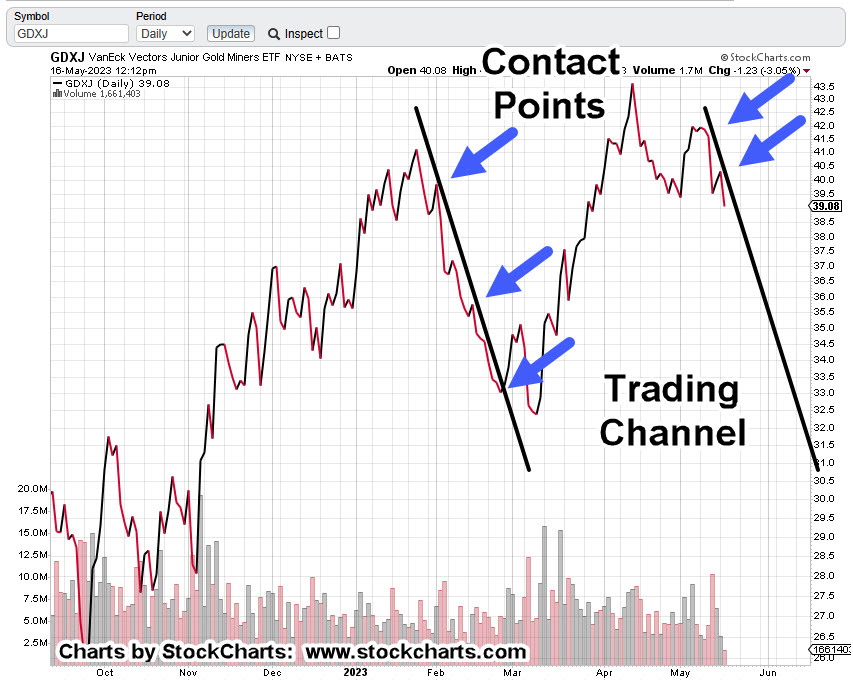

Not covered yet, is the apparent repeating trendline and potential trading channel.

That is shown on the daily close chart of GDXJ, below:

Junior Miners GDXJ, Daily Close

At the minimum, on the right side of the chart we have a down trendline. An upside break of this line would negate any short positions … (not advice, not a recommendation).

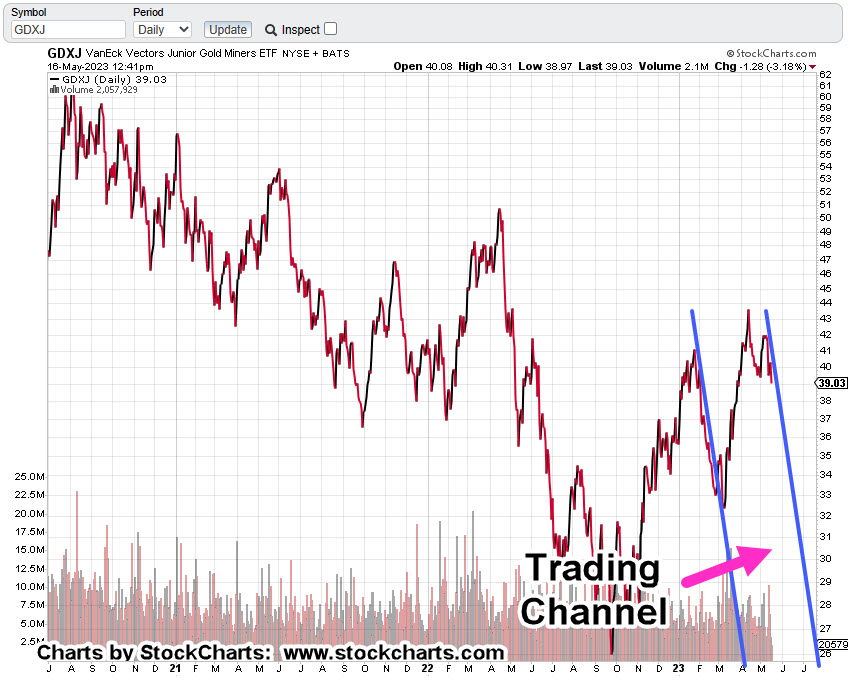

The compressed chart of GDXJ (below), shows the potential.

As of this post (12:57 p.m., EST) GDXJ, continues to move decisively lower. Gold (GLD) and silver (SLV) have reversed to the downside.

Gold’s reversal potential has been discussed previously here, and here.

No one expects a significant reversal in gold …. no one.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279