It May Still Get There … But First

Just as this report said nearly a year ago, there’d be no Fed pivot (still waiting), this article from seven months ago, prompted a mental note to revisit the ‘$30/oz’, silver prediction.

Before we address that, let’s go way back to this post over three-years ago, detailing how the miners, and silver for that matter, are not (yet) in a sustained bull market.

Now, we have the Fed ‘pivot’ set-up and the metals (especially silver) posting a non-confirmation.

The (non) ‘Pivot’

Obvious to only a few (like Uneducated Economist), is how the ‘pivot’ narrative is a false.

Typing in ‘Fed pivot’, into YouTube turns up a massive list. Everybody’s jumping on board.

That in itself, may be cause for alarm.

From a strategic standpoint, we’re not in Kansas anymore.

The 40-year long bond bull market (1980 – 2020) has been broken. Higher rates for longer, like maybe another forty-years, may be the norm (not advice, not a recommendation).

Silver Still Down

Silver (SLV) is far below its 2011, highs: approximately -55%. In addition, SLV, may be on its way to test the lows of SLV, 12.50 – 13.50. More on that in another post.

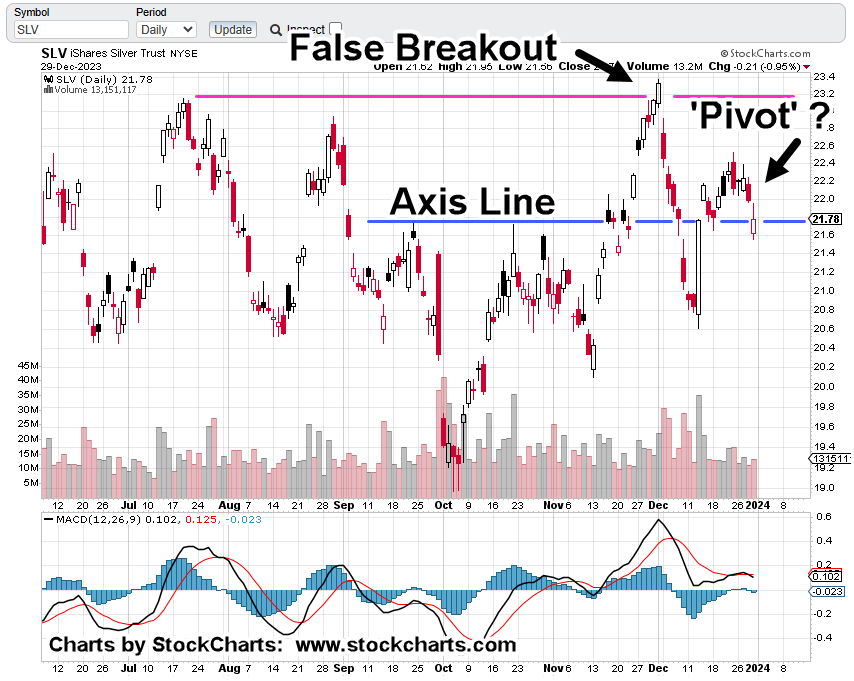

Silver SLV, Daily

The chart shows we’ve had a false breakout (Wyckoff up-thrust), then reversal, and now an apparent test that has (so far) pivoted lower.

The inference is, the silver market’s not buying the Fed ‘pivot’ and subsequent inflation narrative.

It’s possible, the economic collapse narrative like here and here, is weighing more on silver … a narrative that’s actually happening. 🙂

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279