More Volume … Less Net Distance

It’s been about a week since the last update on silver and the ‘usual suspects’ are out in force … again.

One of these days … Alice!

I like the metals as much as the next guy, but that doesn’t help when it’s time to stay focused on what the market’s (really) saying.

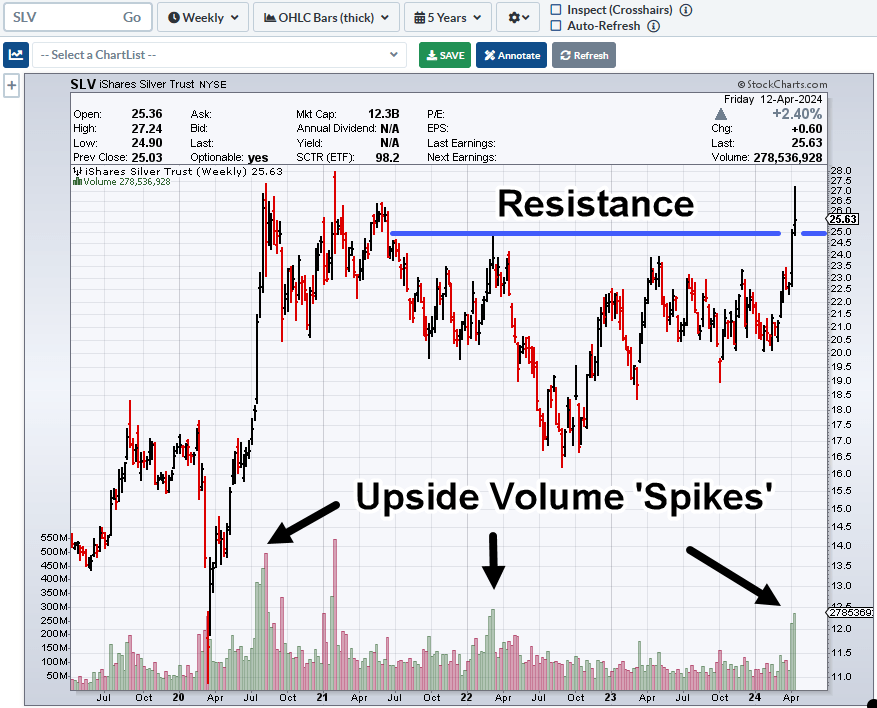

This week’s volume in SLV, was more than last week by about 16%, but net distance traveled (at the close) was far less … about 74%, less net travel … ruh, roh.

Silver SLV, Tracking ETF, Weekly

There’s a wide price spike for the week but it’s the close, that’s the important part, holding just above resistance.

Obviously, what happens next is important.

Typical market behavior for silver suggests we’re at or near a top and due for some kind of downside move if not a complete reversal (not advice, not a recommendation).

Different This Time

If this time really is different and we’re in the long-awaited hyperinflation move, we’ll probably find out soon.

If that’s the case, meaning, it really is different, one would expect the behavior of the metals to change; like silver holds its current level, moves higher, or starts congesting for another up-wave.

So, let’s see what happens next.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Biotech Breakdown … Is This It? « The Danger Point®