The Water’s Fine, Come On In

The financial press and their lackeys, expects the Fed to pull a rabbit out of a hat and lower rates.

The public’s perception seems to be:

‘Happy days are here again’, if rates get lowered, I’ll spend and spend. I can’t help myself, there is no end. So, get rates lowered, again.

Wyckoff warned about the financial press over a century ago. Since then, not much has changed.

In fact, it’s probably worse.

The public thinks rates are coming down. It’s the ‘credible threat’ as Uneducated Economist puts it. The Fed ‘threatens’ to lower rates, and it ‘happens’, sort of.

Actually, rates aren’t lower, but the market has distorted itself, as if they were.

So, let’s get past the narratives and go straight to the truth, price action in the bond market.

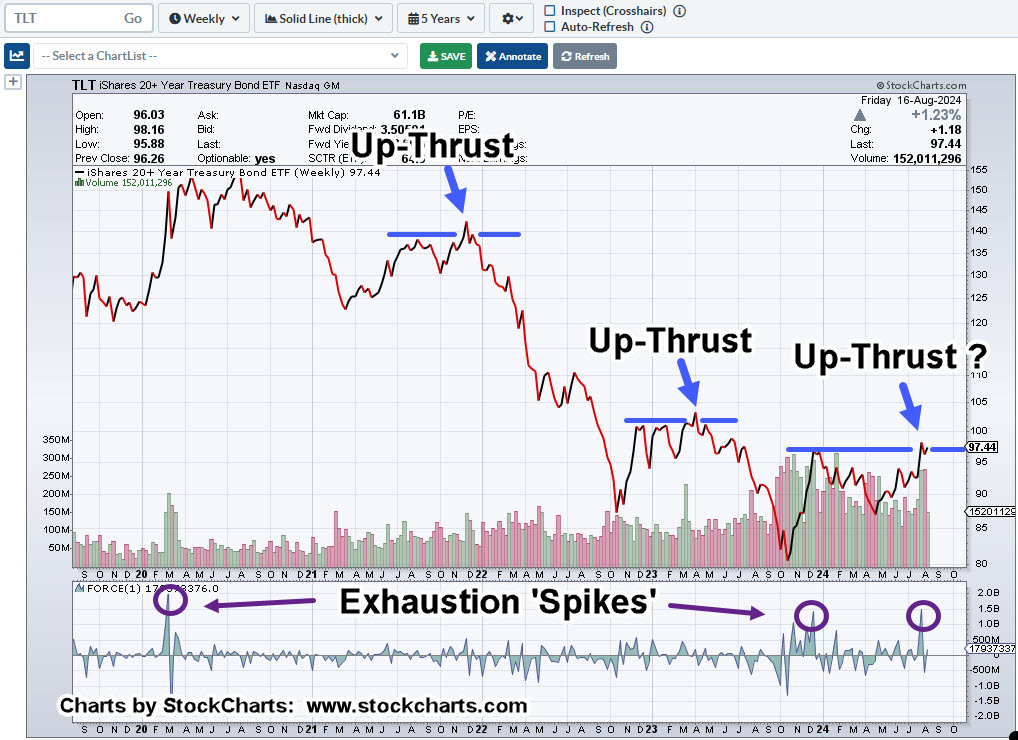

Long Bonds, TLT, Weekly Close

As my mentor Daivd Weis used to say: “What do you see?”

I’ve already marked-up the chart and I see one Wyckoff Up-Thrust, reversal, after another (not advice, not a recommendation).

That, along with exhaustion spikes in Force Index, at or near significant reversals.

The ‘Scary’ Part

Wyckoff analysis is not only price action, it’s volume as well.

Look at the volume in TLT, over the past year.

Massive inflow and what has price done? It’s gone essentially nowhere.

Wyckoff called this ‘Effort vs. Reward’. Lots of effort with little (net) reward.

Add to that, a potential exhaustion spike in Force Index (far right side, purple circle).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279