Setting Up, For The Downside

The next trade (lower) could be in silver itself, or it could be in the Junior Miners, GDXJ, and/or SILJ, the sectors (ETFs) most susceptible (not advice, not a recommendation).

The last time silver had a major downswing was in early-to-late 2022; tracking fund SLV, declined about -35%, top-to-bottom.

During the same period, Junior Miners GDXJ, declined over -50%, so take your pick.

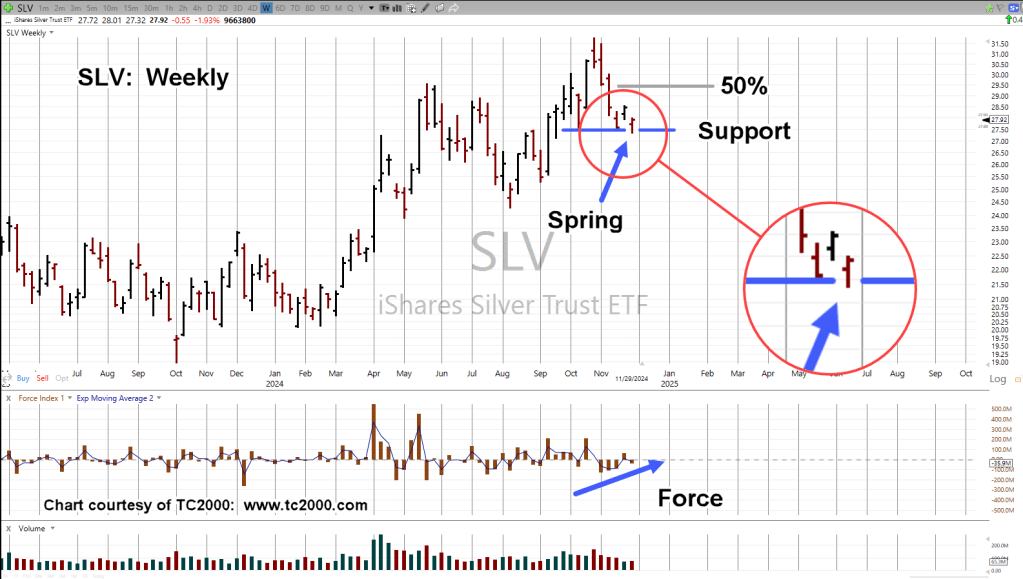

Silver SLV, closed out last week penetrating downside support and then moving (inching) back higher.

We should all know what that means. 🙂

Silver SLV, Weekly

Silver penetrates support and then retraces; Wyckoff ‘spring’ position (not advice, not a recommendation).

The 50% retrace area is shown. It will be interesting to see if SLV, gets that far.

Perhaps more interesting from a set-up standpoint, is what GDXJ, and SILJ, will be doing if and when that happens.

Positioning: SLV & Miners

The mining sector has been ‘out-of-favor’ since this update years ago.

Since that time and looking at the charts, the most dynamic (fastest action) trade opportunities, were to the downside.

There are no open positions in this sector at this time (not advice, not a recommendation).

Positioning: Biotech, XBI-24-01

Separately, as stated in this update, the short trade in biotech (via XBI) was brief.

It was stopped out with a loss of 0.15-pts (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

.

Pingback: Silver … To ‘Blip’ and Back « The Danger Point®