Biotech’s, Tale of Two Channels

What happens after the squeeze?

If it really was a squeeze, then demand evaporates, and prices (tend to) collapse (not advice, not a recommendation).

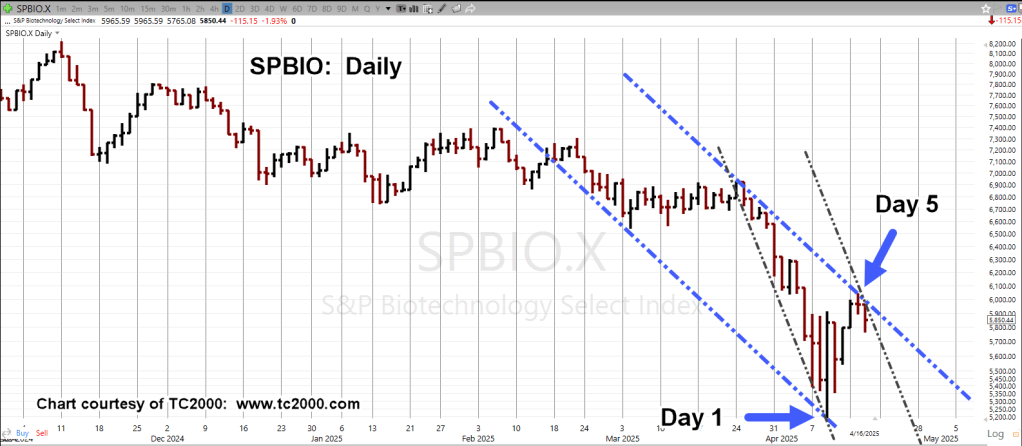

In the case of biotech, not only did we have a potential squeeze, two separate trading channels appear to be in effect.

Biotech, SPBIO, Daily

Both channels have contact points, Fibonacci 5 Days apart.

The more aggressive channel (grey dashed lines) has yet to be fully confirmed.

At this point, it’s essentially one contact on the right side.

Positioning

Remaining short this sector with LABD-25-08.

The stop has been moved (up on LABD) down to the XBI high, at XBI 76.24; effectively 10.24 on LABD, (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: ‘Curve Fitting’ Biotech … Part 1 « The Danger Point®