Gold & Silver Miners (shorts) Capitulate?

Did the shorts just run for the exits?

Yesterday’s hysteria created yet another potential (sustainable) silver breakout, maybe.

Silver Surges: Breaking out of Triangle Pattern to New Highs in 2025, link here.

Producing another rush by the herd, attempting to trade what’s already happened.

The Silver Squeeze Awakens: Options Market Screams for More, link here.

The last update said ‘today could be the day’ … the day we get a downside reversal in the miners.

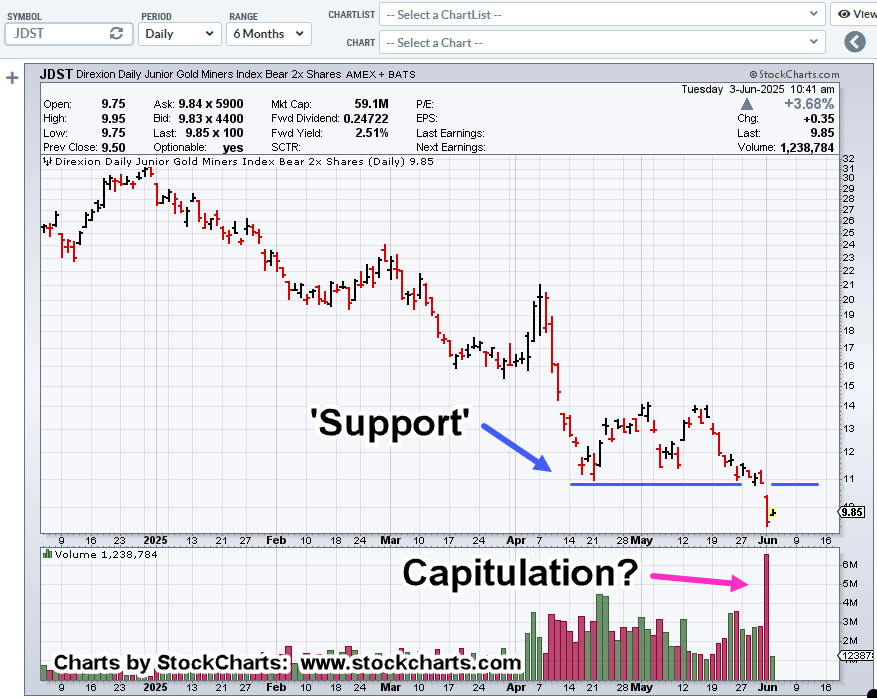

Instead, we have potential JDST short-side capitulation; with inference of GDXJ, downside (not advice, not a recommendation).

Junior Miners 2X Leveraged Inverse Fund JDST, Daily

Today is an important day.

Will we get follow-through on GDXJ (up) and JDST (down), or will the hysteria fade?

If this really is a silver squeeze, one would expect the market (SLV) to scream ever-higher (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279