EEM, Closes The Gap

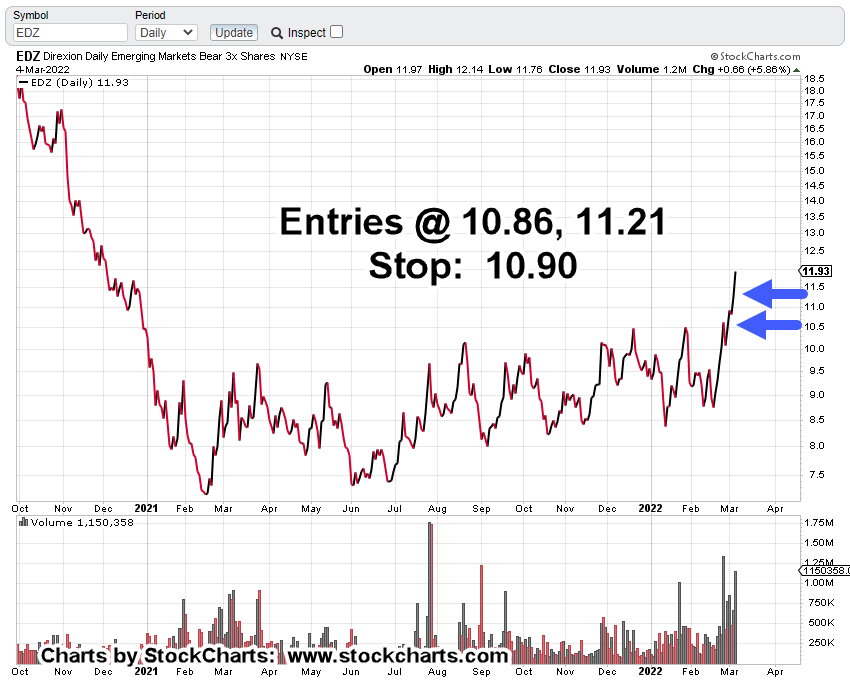

Active Short: EDZ-22-01, Update

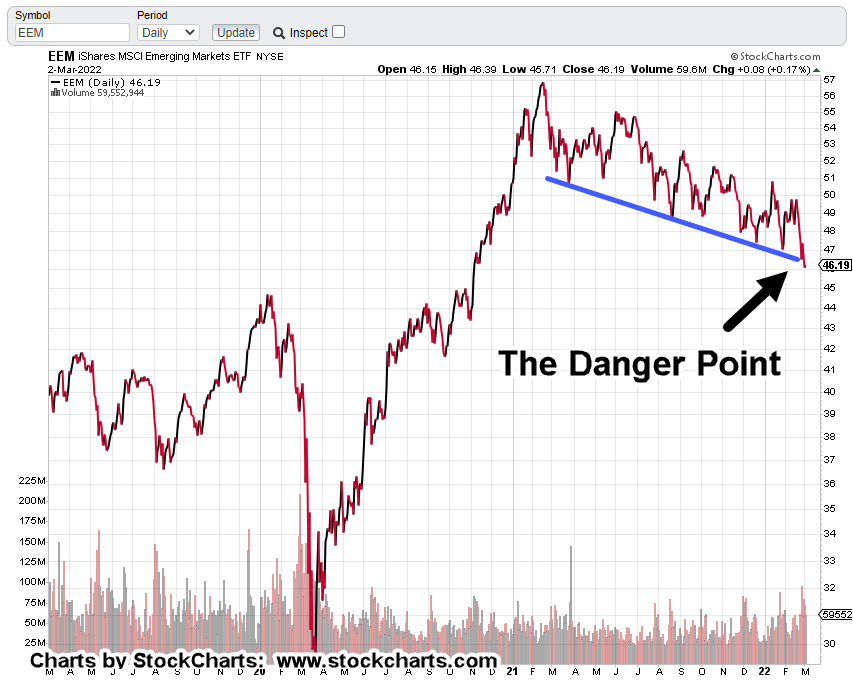

This post, highlighted the reasoning for a sustainable breakdown in the Emerging Markets, EEM.

The leveraged inverse vehicle for that index is EDZ.

Up until about two weeks ago, that fund was a low volume wall-flower.

That’s all changed … at least, for now.

The ten-day trading period from February 1st to 14th, had average EDZ, volume of 251,000 shares/daily.

Fast-forward, ten days from February 24th, to today, March 9th; average volume is up over 280%, at 955,000 shares/daily.

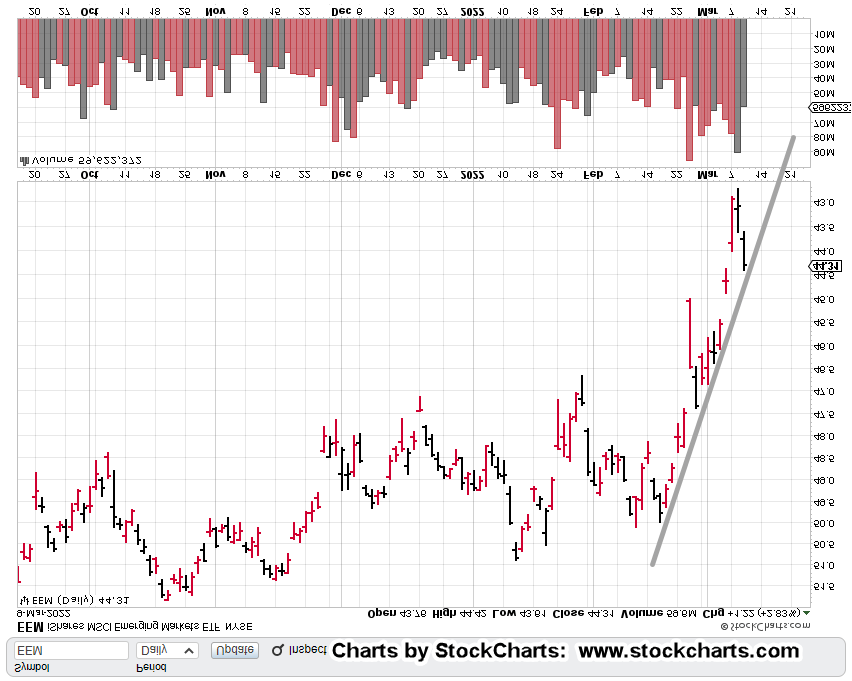

EEM Weekly Chart

The weekly chart’s orderly lower-trending price action broke to the downside during the week of February 25th.

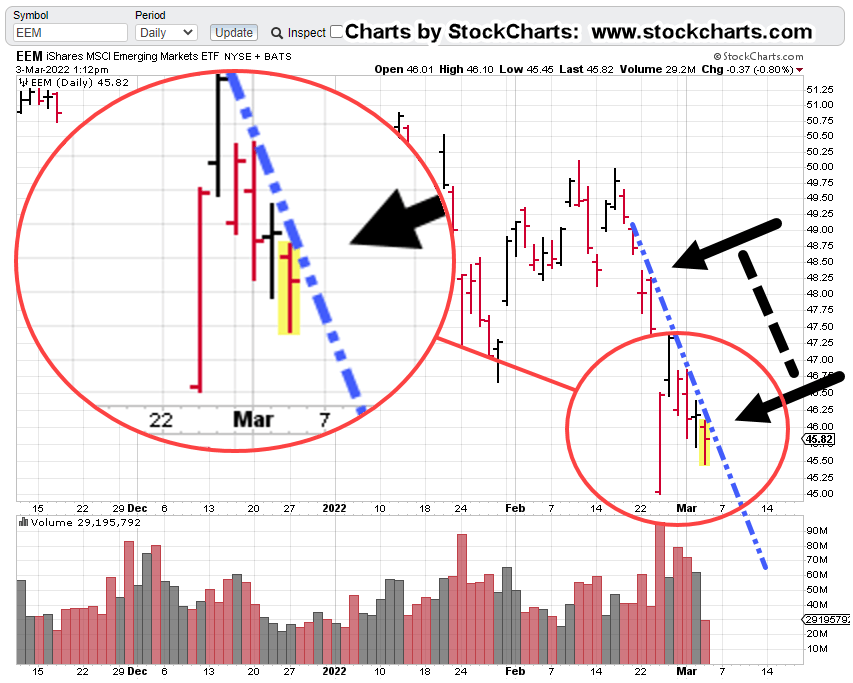

Inverting the chart and noting the apparent trend-line shows this week’s action is closing the breakout gap and testing the trendline.

Closer-in on the (inverted) daily shows just how many hits there are on this trend; looks like about eight so far which includes today, March 9th.

Positioning

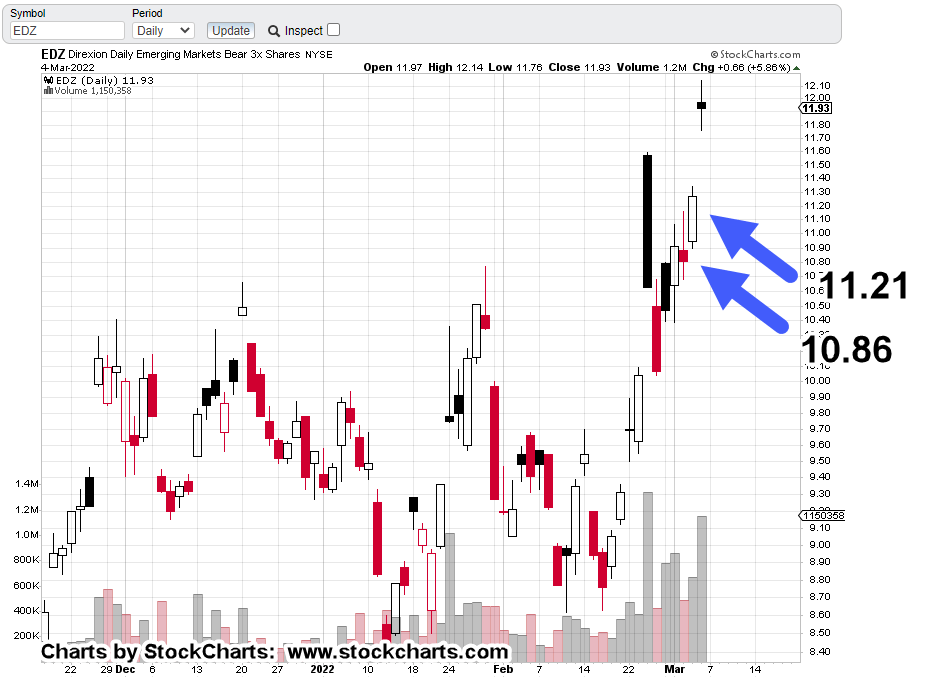

This earlier post showed how I worked the sector via inverse EDZ (not advice, not a recommendation).

Depending on tomorrow’s price action, today may have been another low-risk opportunity for entry.

If EDZ makes a new daily high at the next session, the stop, identified previously (EDZ: 10.90) will be moved up to 11.96 (not advice, not a recommendation).

Opinion

This article says, ‘limit down‘ is coming; the opening market drop will be so large, it’ll be ‘limit down’, not allowing sells (for a set time period).

If that happens, the next day is likely to be the same and the next after that.

This is how fortunes are made and destroyed.

A good documentary on that process can be found here (Floored, time stamp 29:04); back then, it was a limit up.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279