Holding Below Support

Holding on for its life, just below support.

That’s the current condition (as of 12:23 p.m., EST) of the SOXX.

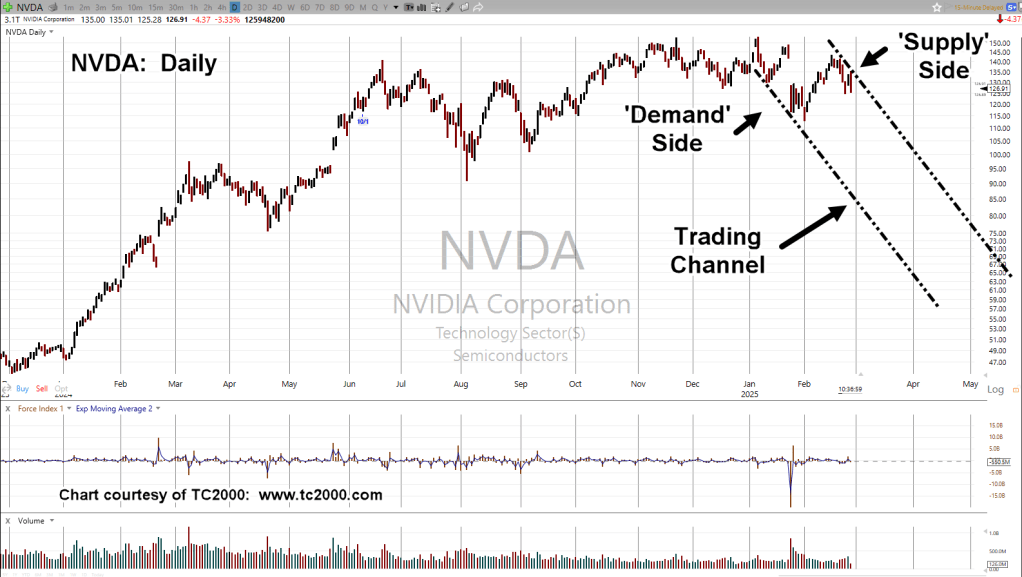

When we look at the chart, penetration of a three-month support area is clear.

By definition, when support is penetrated, it puts the market in Wyckoff Spring condition; there will (typically) be some kind of attempt to rally.

That’s where we are now.

Semiconductors SOXX, Weekly

Note the black dashed trendline.

Research done on bubbles past, link here postulated at the break, the multi-year down leg begins (not advice, not a recommendation).

After the SOXX broke the trendline, it spent an incredible 10-weeks testing that break before reversing lower.

Positioning

From a price action standpoint, there’s nothing (yet) that says to exit a short position (not advice, not a recommendation).

Stated above, SOXX is technically in ‘spring’ position, ready to move higher.

With that in mind, the stop for SOXS-25-09, has or will be moved up to the session low; currently at SOXS 22.31 (not advice, not a recommendation).

Update: 1:39 p.m., EST: Price action expected to continue unabated (downward) after the first half of the session, now showing some buoyancy: Discretionary exit of SOXS-25-09, profit +14.2%

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279