Heading Off The Cliff ?

We’re about to find out.

The last update presented that whatever happens with biotech (SPBIO), it’s likely to be decided quickly.

That conclusion was based on the ‘rule of alternation’ and the fact, the whole short squeeze event from last week, did not result in a new weekly high.

That, Was Then

What we have now so far in today’s session, is an attempt to move higher by SPBIO, which appears to have stalled and now, looking to reverse.

The reversal part won’t be confirmed unless, and until a new daily low is posted.

For today, posting a new low is somewhat of a tall order because of Friday’s wide trading range … but we’ll see.

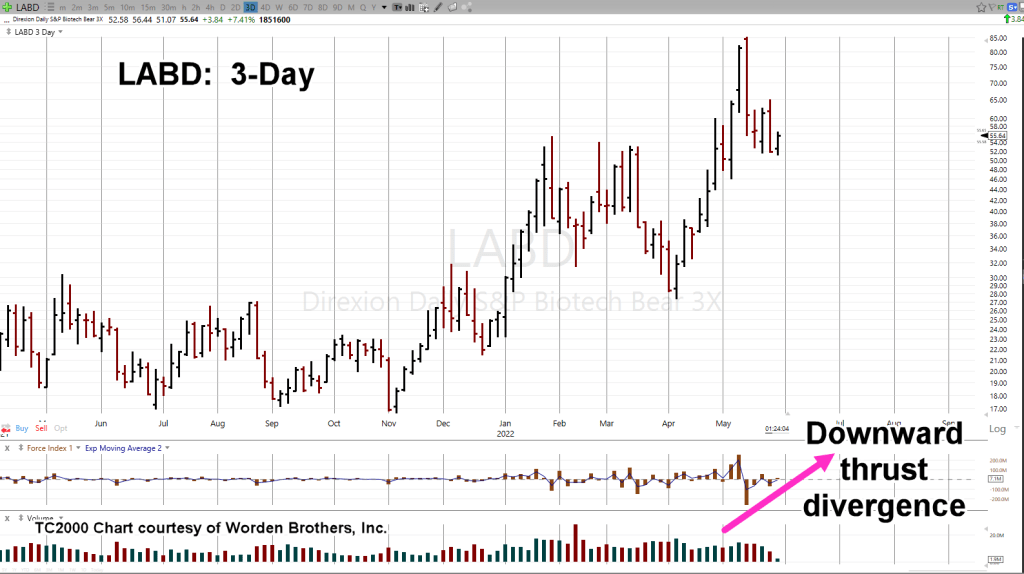

Instead of going to the actual index, SPBIO, we’ll look at the 3X leveraged inverse fund LABD

SPBIO, 3X, Leveraged Inverse, LABD

Note:

The chart below, is a 3-Day chart with Friday, completing the last ‘third’ day.

As price action has moved lower, energy behind that move is weakening; seen in the thrust divergence

Why a 3-Day Chart?

When’s the last time you saw a 3-Day, 2-Day, or 6-Day, or any other non-conventional chart in anyone’s analysis?

Anybody? … Bueller? Bueller?

It’s not different, just to be different.

Shown below, we have the same 3-Day LABD, compressed and marked up with a trading channel.

At this juncture, the 3-Day shows the nuances more clearly.

If this trading channel is in-effect, that is, if it’s active, potential exit points for an LABD position at this point in time, would be 105, or 240 (not advice, not a recommendation).

For LABD, to get anywhere close to those points, especially the second (240-level), biotech would need to collapse.

Summary

There’s plenty of chaos to go around. We have those who are still arguing whether or not ‘it’s the bottom’.

Such arguments are potentially (and likely) from those completely unprepared.

As Jerimiah Babe said in one of his latest videos, ‘something’s going to break’.

When or if that break happens, it won’t be to the upside.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279