Last Gasp Before August 23rd?

The SOXX chart pattern (below), is telling us we’re likely in a case of …’buy the rumor, sell the news’.

Yesterday’s action may have negated any immediate reversal downward.

Now, it looks like we’re going into a terminating wedge targeting SOXX higher to approximately 550 – 560 (not advice, not a recommendation).

Of course, anything can happen.

Semiconductor SOXX, Daily

Note, the potential for a bearish MACD divergence if SOXX moves to new highs.

If we thought there was hysteria now, just think what’s it’s going to be like if SOXX breaks to the upside.

Party, like it’s 1999

Then, Biotech SPBIO

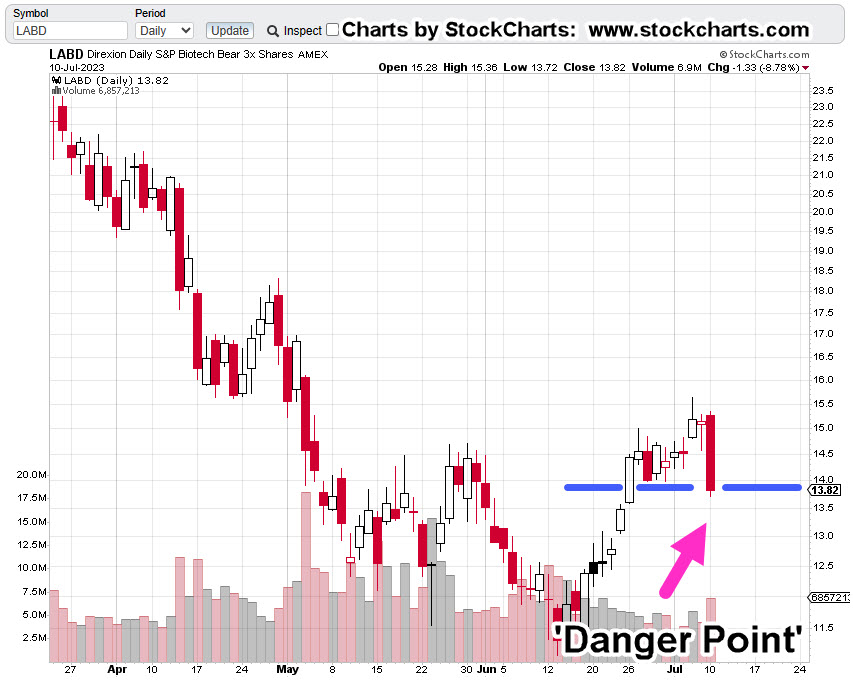

Meanwhile back at the ranch, with about a half-hour to go before the regular session, biotech leveraged inverse LABD, is hovering at yesterday’s lows.

Biotech SPBIO, Leveraged Inverse LABD, Daily

Support (blue line) has been penetrated.

Price action has stopped dead … thus far.

This sector has been the downside leader (LABD, higher) in the past so, we’ll see if that’s happening now.

The ‘Life Insurance’ Correlation

There appears to be correlation with potential downside reversal in biotech and possible downside reversal in the life-insurance sector.

We’ll discuss that in another update.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: The Last of The Bubble(s) « The Danger Point®