Below Resistance & Trendline Break

Tomorrow’s the Fed interest rate announcement; anything can happen.

The way it stands now for biotech XBI (the day prior), an upside rally is against the odds.

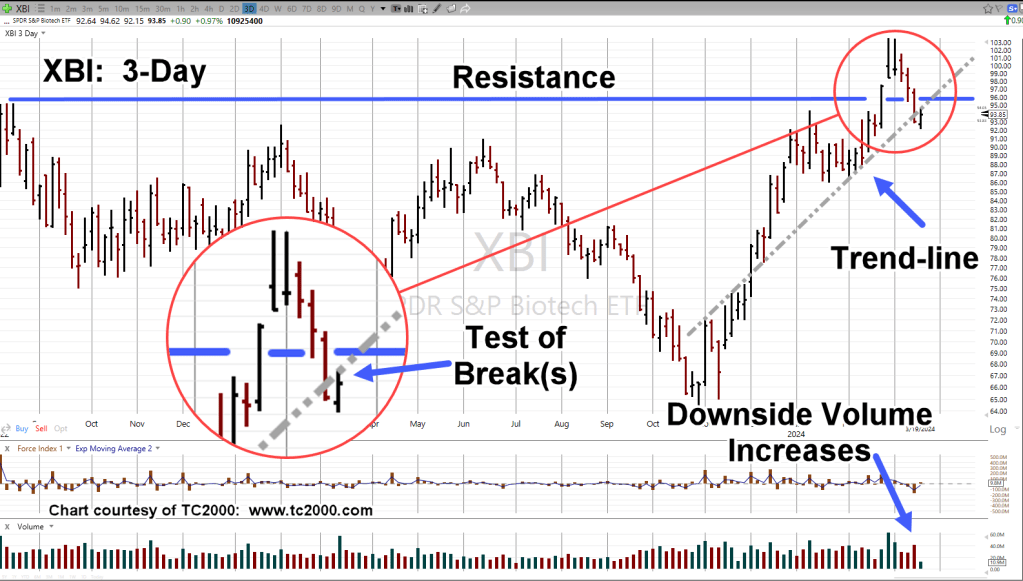

The chart below for the sector is a busy one.

Biotech XBI, 3-Day

Price action’s below resistance (possible false breakout), has broken an upside trend to the downside (grey dashed line) and today, has come back for a test of both.

Breaking below resistance was accompanied by increased volume; bearish.

A significant amount of demand will need to show, to get this market back to the bullish side (not advice, not a recommendation).

The Fed interest rate announcement is scheduled for Wednesday, 2:00 p.m., EST.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Awesome work on XBI. David W. speaks the same about probabilities and trying to stack them in your favor and then taking a trade. Have an awesome day!!

Richie

LikeLiked by 1 person

Richie,

Thank you for the compliment.

It seems we’re still early in this move (if it’s a sustainable reversal) and anything can happen.

Even so, you have probably already discovered that XBI has formed at least one trendline and possibly a trading channel.

If it continues the reversal lower, two projections are planned: one a ‘measured move’ and one a P&F chart.

Regards,

Paul

LikeLike

Pingback: The Concept of ‘Test’ « The Danger Point®

Pingback: There Are No ‘Rate Cuts’ « The Danger Point®