Early Signals

It’s never too soon to look for a trend.

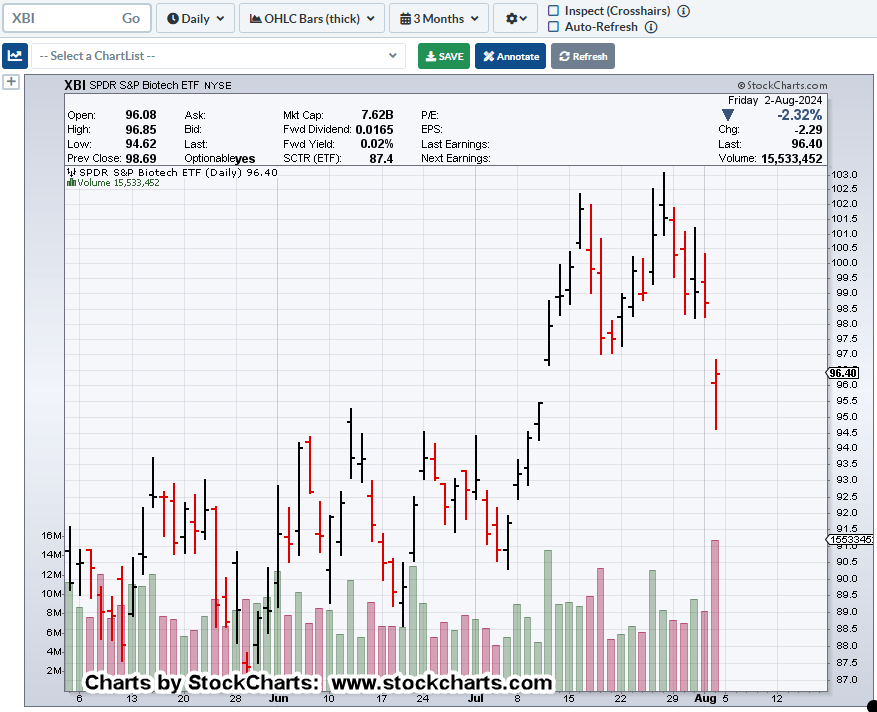

The daily chart of biotech XBI, may be showing us early signals of a trend as well as trading channel.

Back in the day, when being mentored by David Weis, he would typically start the session by putting up a chart on his computer (with me logged in remotely) and then ask:

“What do you see?”

More importantly, he did not ask, what I ‘thought’ or what the Fed was doing, or any other mainstream form of distraction. No, it was always “What do you see?”

So, we’ll do the same.

Biotech XBI, Daily

We’re moving in close with the (un-marked) 3-month, daily; what do you see?

Two things should be noticed almost instantly.

Frist: Heavy volume at the last session this past Friday.

Second: Price action (the close) is hanging in ‘mid-air’ with the next support level over two-points away, near 94.0.

Now, for the marked-up charts.

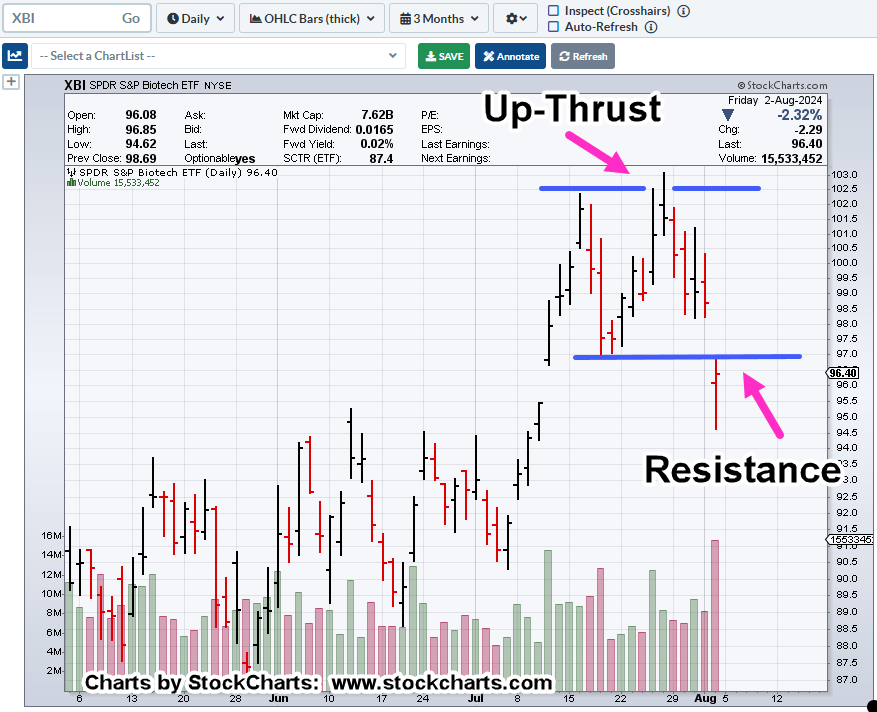

We’re using the ‘reverse’ trendline technique, presented in the Weis video to determine a potential right side trendline (black dashed line).

Next, we have the Up-Thrust on the daily which is also the right side of the ‘double top,’ shown on the weekly.

Taking both timeframes together, implies a significant inflection point (not advice, not a recommendation).

Anything can happen and the market could recover at the next session.

We’re below support (now resistance) and therefore, technically, in Wyckoff ‘spring’ position.

However, probabilities indicate we’ve had a downside pivot of some significance. That, along with heavy volume at Friday’s session would imply follow through at the next session (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

HI Paul! Awesome post on the XBI man. Your work is so focused on price/volume/patterns and NOT news crap. I really can’t wait for your posts to show up in my inbox!! Is “Three Ten Trading” a firm that is currently open? The link in your XBI post brought me there. Thanks again and I hope you and yours are doing great!!! Richie

LikeLiked by 1 person

Richie,

Thank you for your comment. Your input is important.

You are absolutely right. The news, if one can call it that, is somewhere between disgusting and putrid (my opinion).

Ignoring it, as Wyckoff told us to do, is near impossible because of the opportunism and the shameless grift.

For example, we have (financial) YouTube channels with one click-bait title after another, offering no real value, or more importantly, no seasoned (i.e. 37-years of) experience.

Personally, I am thankful I’m not 20 or 30 years old or even 40 and trying to figure out (from the press) what is real or not.

The corporate site Three Ten Trading contains proprietary data and indicators and is not open to the public.

However, changes are planned for this site to include more detailed information, analysis, commentary, on the markets and their characteristics.

Finally, I am pleased you find these posts to be of use and also recognize you to be a small select cadre of market participants that knows the Wyckoff secret.

That secret, from his Autobiography, ‘The markets move with a power of their own that have nothing to do with valuations’.

Being able to read and decipher the price action is the key to that ‘power’. Few there are, that understand this concept.

Once again, your comments are appreciated.

Thank you and best regards,

Paul

LikeLike

Pingback: Brokerages Blow Up « The Danger Point®