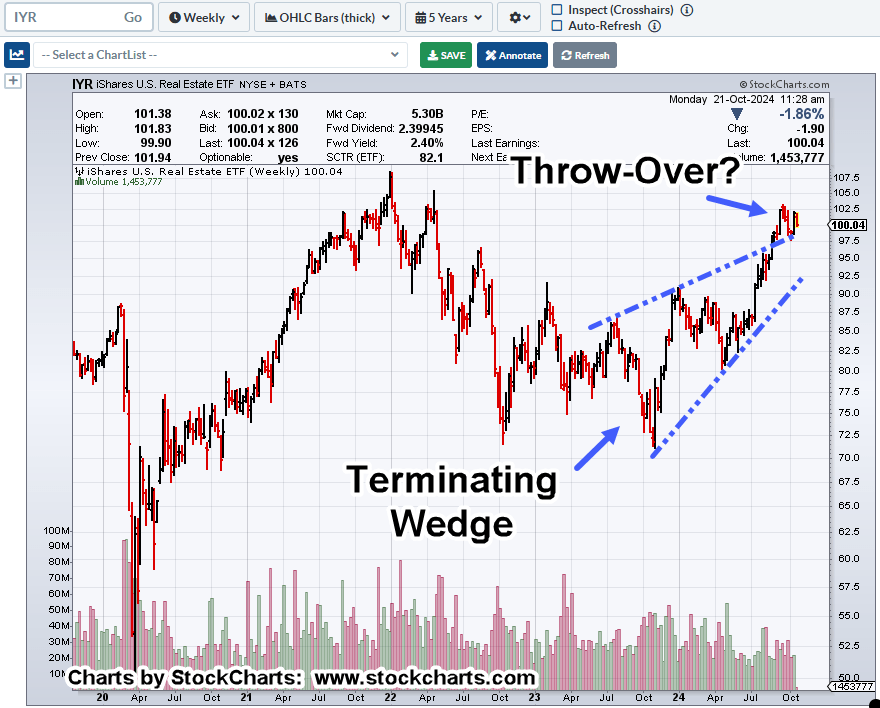

Massive Wedge Pattern

Bonds (TLT) reversed on 9/17/24, the day before the Fed ‘cut’ and never looked back.

Rates continue to rise.

Meanwhile, real estate (IYR), has been whistling past the graveyard; that is, until now.

Real Estate IYR, Weekly

If the wedge is in-effect and we’re in a throw-over about to return into the pattern, it signals a very bearish condition (not advice, not a recommendation).

Even the illustrious financial press is starting to catch on that something’s not quite right. 🙂

Of course, you have to ‘subscribe’ for information like this.

As for this site, the current (bond) reversal was first identified and discussed, here.

Back then …

“Looking at the Fed calendar, link here, it’s a very interesting date; ‘the day after’ November 5th.

Let’s see if the ‘rate cut’ is immediately reversed (not advice, not a recommendation).”

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: D.R. Horton Takes A Hit « The Danger Point®

Pingback: Rate ‘Expectations’ « The Danger Point®