Data-Center (lease) Cancellations

One of many to come?

The article at this link says the cancellation move was ‘unexpected’.

Clicking on ‘Artificial Intelligence’, (side-bar) and going back to August of ’23, with this post, then reading though subsequent posts, one can say the ‘cancellation’ was fully expected.

That August ’23, post has the link to Prechter’s analysis; we’re in the largest asset bubble in at least 300 years (not advice, not a recommendation).

All of that brings us to chief cook and bottle washer, Nvidia.

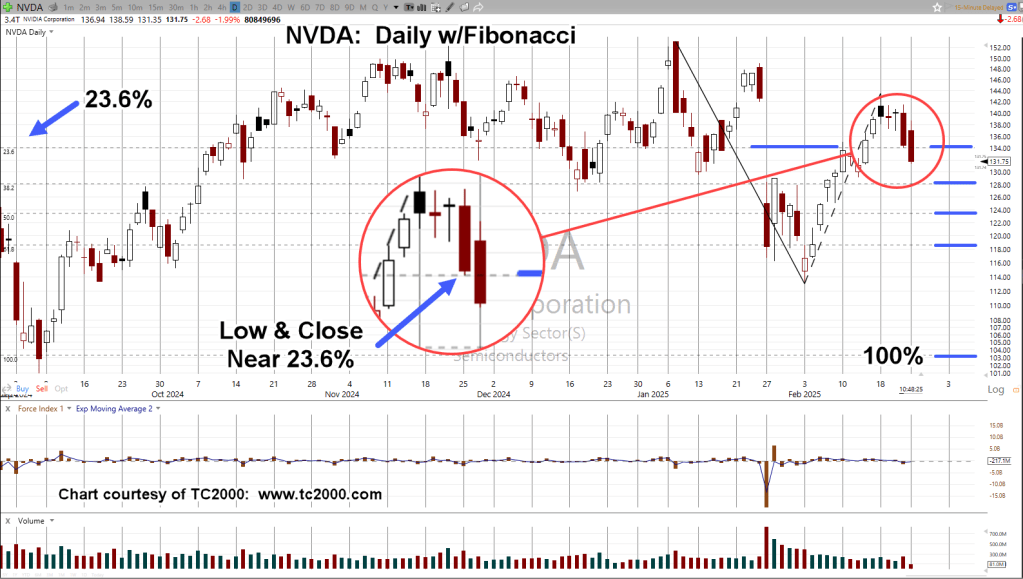

Nvidia NVDA, Daily

We’ll cut straight to the chase (as of 11:35 a.m., EST).

A Fibonacci projection is overlaid starting from the all-time-high (1/7/25), to the recent lows (2/3/25), back up to test (2/18/25), then reversal, again.

Note how last Friday’s price action printed and closed near the 23.6, Fibonacci projection.

Positioning

Everyone has their own preference and style.

As stated in the ‘About‘ section, this site works to emulate behaviors of the three masters listed.

That, in addition to the once-in-a-lifetime opportunity to have been mentored by the late David Weis, results in what’s available on this site.

With that said, positioning in the SOXX (the A.I. proxy) is short, via SOXS, as SOXS-25-08, initial entry link here (not advice, not a recommendation).

Note: SOXS-25-08, stop to be moved to the day’s session low; currently 18.58 (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279