Who’s Is Taking Your Trade?

As a trading professional, you must know (or have a good idea) who’s on the other side of your trade.

Whom are you competing against?

It’s just one of many questions to be asked (along with price action) when estimating the opportunity; whether long or short.

Well, ladies and gentlemen, here’s some of what’s on the bullish side of Nvidia, link here.

So, according to the video, tech stocks (and Nvidia) went down because of the U.S. 10-yr Treasury?

Think about it. ‘Likes’ vs. ‘Dislikes’ on that video (as of this post) are over 13:1.

How about this:

Nvidia went down because it posted the largest ever price action down-thrust; then, went through a test of that action, completed the test, then reversed to the downside.

Wow, sounds so clear when put that way. 🙂

With that, let’s get back to reality.

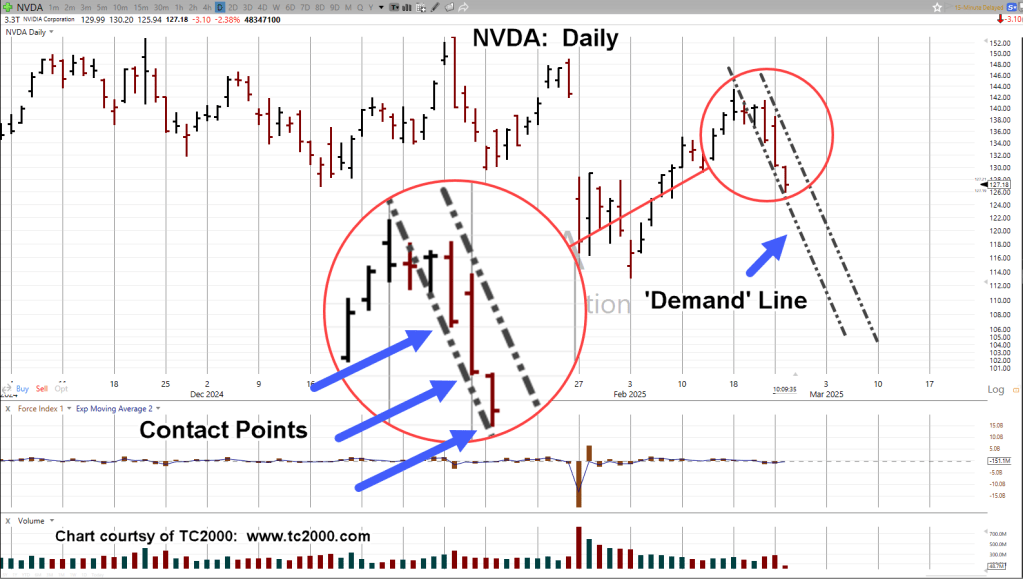

Nvidia NVDA, Daily

Earnings are scheduled for after-hours tomorrow. Things could get interesting.

In the meantime, we have a demand line and possible channel.

As of this post (10:47 a.m., EST), NVDA has sliced through support at the 129 – 130, level with ease.

We should expect a test of that support. However, at this point, price action is quite weak (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: All Eyes on Nvidia « The Danger Point®