Breakout Into Resistance

Both biotech funds, IBB, and XBI, are now in an up-thrust (potential reversal) condition.

In each case, the ETFs have pushed through a long-established trading range, straight into resistance.

The last update focused on less liquid IBB, because it was not known if heavily traded XBI, would push through its trading range (being the weaker of the two).

Since that initial update, both indices are now above their trading range.

Of course, what happens next is the question.

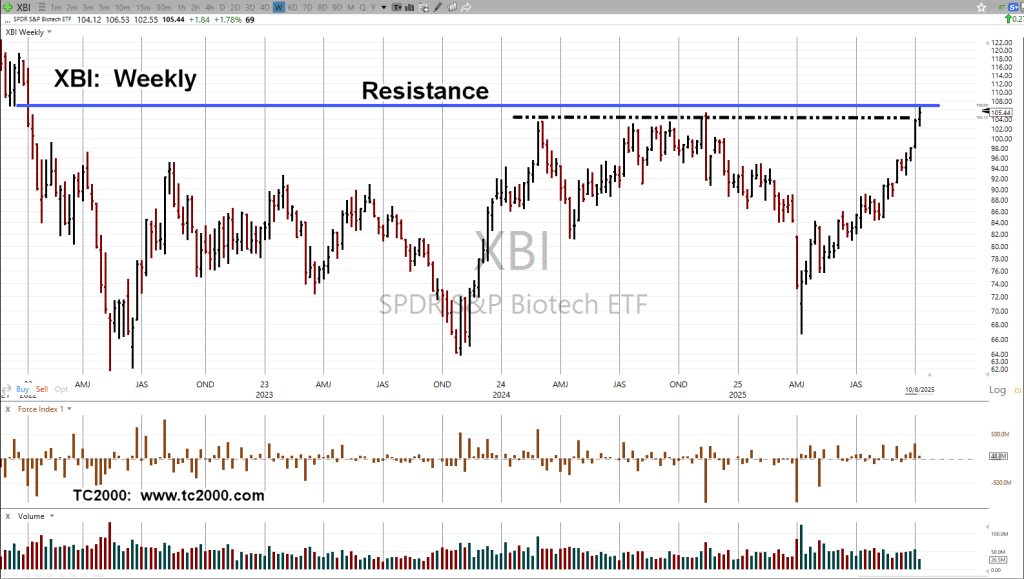

Biotech XBI, Weekly

The blue line is long established resistance.

The black dashed line is the top of the trading range and the up-thrust condition.

At this point anything can happen.

XBI, could reverse immediately or grind its way along, dissipate momentum, or even move higher.

We’re at the point where the risk of being wrong on a short position is least (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Thanks for bringing attention to nat gas. I nibbled a little on today’s pullback. Hopefully it works. And if it doesn’t it’s no big deal.

LikeLiked by 1 person

Glad to be of service. 🙂

The UNG tracking fund pushed below the 13.00 support area which sets up (as you know) a Wyckoff ‘spring’ condition.

My UNG entry was around 12.93 or so … a bit early as price continue to edge lower. I don’t trade the futures as that contract has a nasty habit of spikes in either direction … a lot like silver in a way.

There is the possibility of a ‘seasonal’ effect going into winter with Nat-Gas topping out the last time, in the March time-frame. So, looking for something similar. We’ll see.

As a side note, the silver futures contract had the typical (reversal) spike on heavy volume. I’m not going to short the miners but just saying if that was the reversal for this time around, it’s likely to get very interesting.

Thanks again,

Paul

LikeLike

Pingback: Markets Blow-Up … A Review « The Danger Point®