In the past three days, bonds (TLT) penetrated support and stopped dead.

Anytime a market penetrates support or resistance and halts, it’s an indication that something’s up.

Either the market‘s absorbing transactions at that level to continue on, or it’s a reversal about to happen.

With all that’s known on the short position by the speculators as well as another Van Metre report, bank lending standards, probabilities point toward bond reversal.

The dollar is already reversing higher. Gold has been viciously slammed lower and the overall market’s hovering at all time highs.

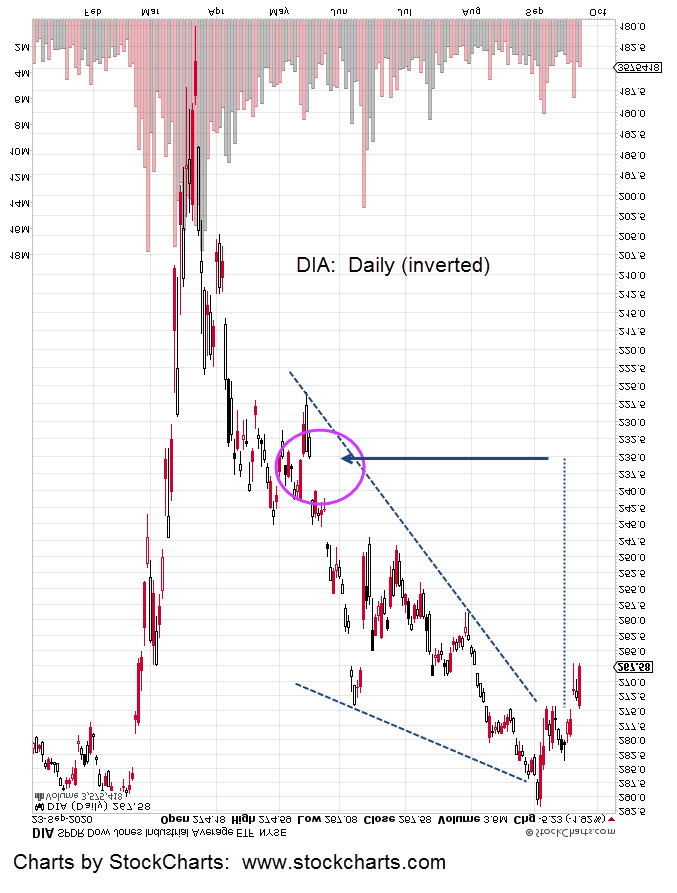

The Dow edged lower at the last session. This session in the pre-market (9:01 a.m., EST) it’s lower again at -1.94 points or -0.66%.

If the Dow (DIA) gets below the 290- area, it’s below resistance and another move higher may be difficult indeed.

We’re short the sector via DXD (not advice, not a recommendation). A new daily low for DIA will allow our position’s stop to be moved to DXD 13.49.

Charts by StockCharts