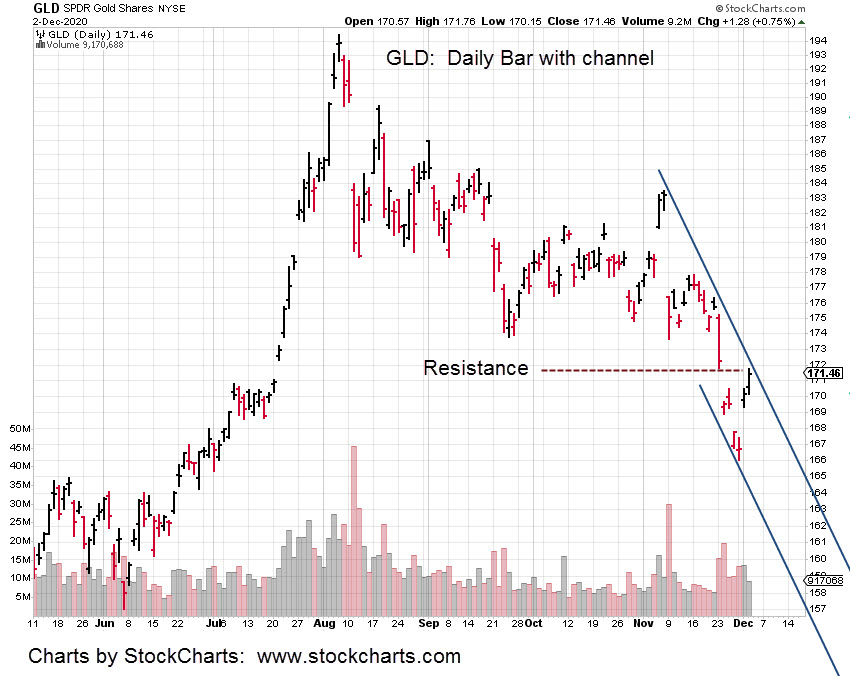

Instead of reversal in the overnight, gold went higher.

Keeping with the potential down-trend theme, we’ll pull out to the next larger time-frame; the weekly.

The 23.6% retrace level, is approximately 172.60 – 172. 70, when measured on the weekly chart. Pre-market action in GLD (as of 8:55 a.m. EST) is at 172.40 – 172.60 range.

So, we’re there.

This is a good example of price action coming back to test wide, high-volume areas such as posted last week. It’s what markets do.

From a trading standpoint, the DUST position could be stopped out if price action remains at this level to the open.

Not a problem. Every trading action results in creating another data point for a future entry.

Moving on to Biotech (IBB):

Using LABD (3X Inverse IBB) as the high-volume proxy, it’s oscillating in a narrow range and essentially unchanged.

Separately, David Quintieri at the Money GPS, comments here, that he’s being chided for not giving financial advice and not indicating which stocks to buy.

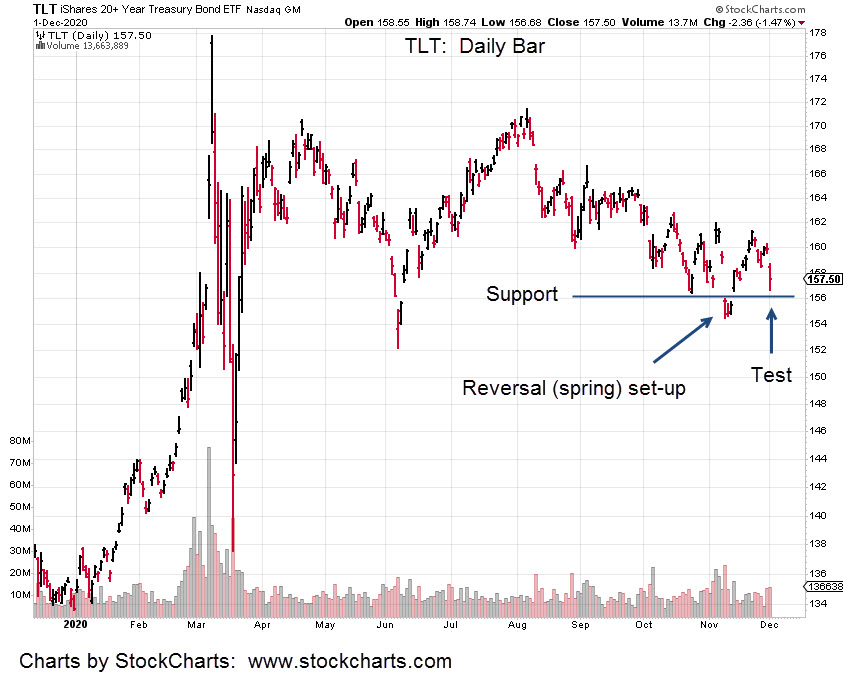

In addition, Steven Van Metre, in this report states the Dollar and 30-Year Bonds are shorted to unbelievable, historic extremes.

He also states that ‘when the market finally reverses, it’s going to be violent.’

The wipe-out, when it comes will likely be on several fronts.

Food supply

Power gird

Cyber attack

“Speck”

Markets

Riots

After those events transpire, figuring out which stock to buy won’t be anywhere on the list.

Stay Tuned

Charts by StockCharts