It may have been Robert Prechter Jr. that said years ago;

‘You’re either going to be early, or late’

He then went on to say his trading method usually puts him in a little early on the move.

That means there are times when the anticipated direction does not materialize.

So, your either suffering through the pain of anticipated reversal (for seconds, minutes, or days), or you’re chasing the market.

You make the call.

There really is no other choice.

Both methods involve psychological pain.

Referring back to Prechter, he also said some of the best traders he knew were former Marines. By definition, they are well trained to deal with pain.

My former mentor, the late David Weis would say after hit on a set-up, if conditions warranted, he would enter again; as he told me, he would ‘stick his chin out’ and effectively tell the market to ‘prove him wrong’.

It was an interesting choice of words for him as one can see from his training video …. he had a distinctive chin.

Trading Style:

The trading style presented on this site is a combination of Wyckoff tape reading coupled with anticipating price action.

As inferred above, that means there may (and will ) be times of draw-down while working to enter a market reversal.

That’s where we are now.

Trade Actions:

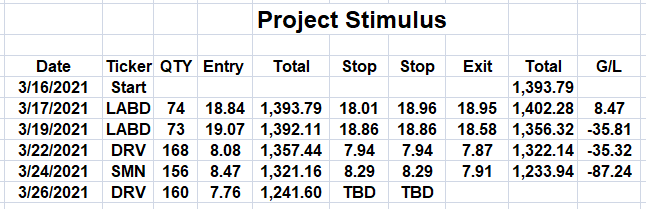

Yesterday’s upward action in basic materials forced the ‘project’ out of its short (SMN) position. That sector may attempt to make a new 52-week recovery high before it’s ready for reversal.

Analysis: Real Estate, IYR

One market that did make a new 52-week high, setting up technically for a short, is real estate:

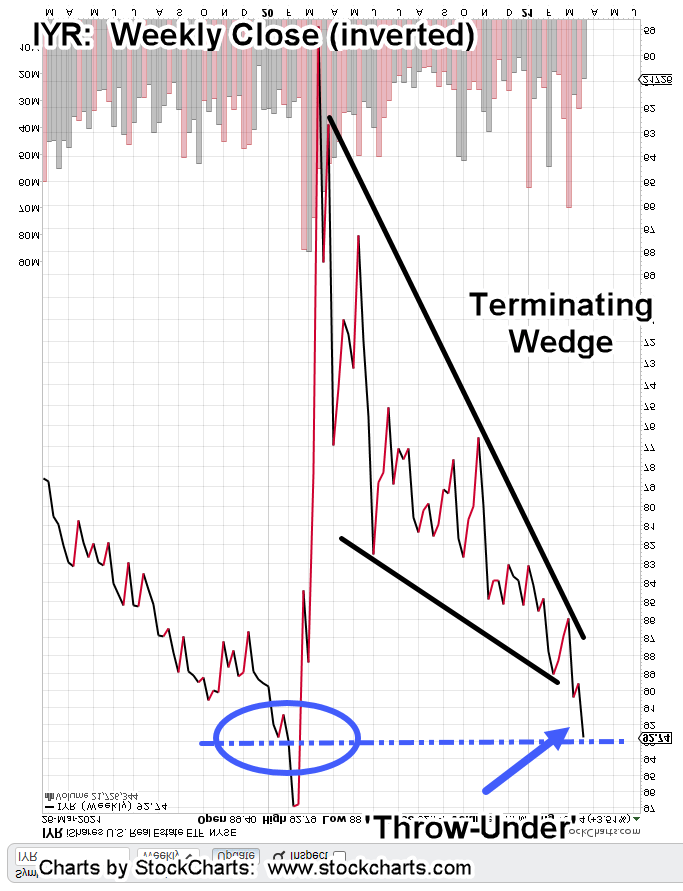

The weekly close of IYR has been inverted (turned upside down) to show the unique technical condition.

IYR has created a large terminating wedge that’s in the process of a ‘throw-under’. At times a market will attempt to breakout of a wedge in the opposite direction of eventual reversal.

This type of breakout tends to fail. Based on the dashed line contacting a prior congestion, there’s’ potential to at least hesitate in this area.

The daily chart below provides additional nuance:

It’s clear price action has contacted two prior areas of support – resistance during ‘throw-under’.

Anything can happen but it seems that IYR’s at maximum extension.

On Friday, IYR price action closed just 0.05-points off its high for the day. That high was also a 52-week high.

We’re now in a support-resistance zone.

If IYR is to move significantly higher, it might need additional fuel (a retrace lower) to break through.

Positioning:

The action then (not advice, not a recommendation) was to short the market via DRV.

Once again, the market itself is telling us where to go for opportunity.

Charts by StockCharts

Pingback: Elliott Wave: American Tower « The Danger Point