Which Is It?

Right along with the current narrative, ‘The Fed’s going to cut rates’, is another narrative, ‘The Fed’s in charge, a leader, and sets rates’.

Is either one, actually true?

Years ago, Robert Prechter Jr. pointed out very convincingly, the Fed’s a follower, not a leader.

His research showed, over many years, the Fed consistently follows the market.

Along with that, was his premise, ‘The market leads the news, not the other way around’.

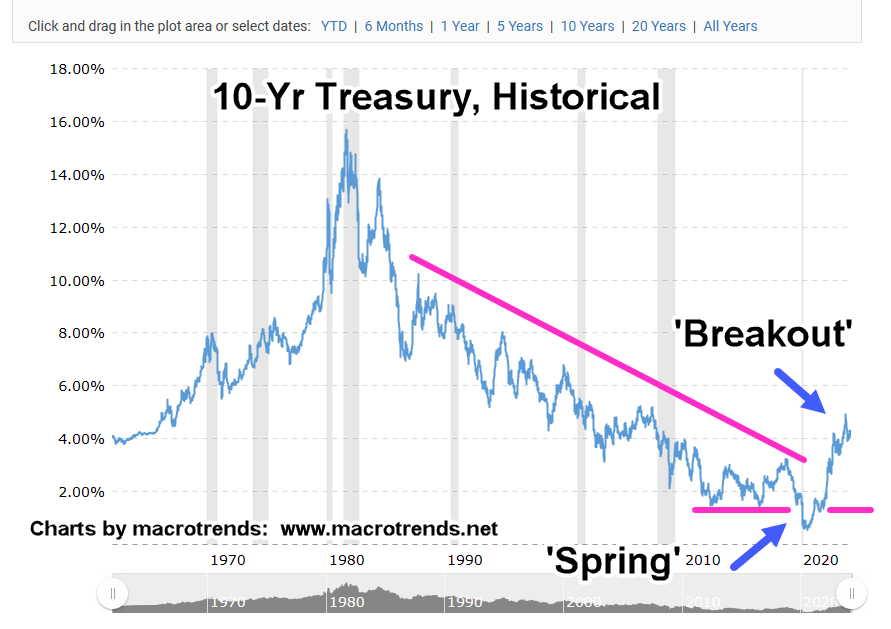

Using that, we’ll look at what the Fed’s likely to do next; let’s use the long-term view, the 10-Year Treasury.

What’s it telling us?

Macrotrends Historical Chart: Ten Year Treasury

As posted in the prior update, the 40-yr bond bull market, i.e., lower rates, is over (not advice, not a recommendation).

We see the upside reversal in rates (downside for bonds) took over 10-years to set up.

Rates pushed below established support into a Wyckoff spring condition, then reversed higher, then into an outright breakout.

Currently, we’re hovering around in ‘no-man’s land’.

Could rates dip lower (bonds higher) and we get a token rate cut in response from the Fed?

Well, as David Weis used to say, ‘Anything can happen’.

Strategy First

However, from a strategic standpoint and for the long-term, higher rates are more probable.

The market has already responded with interest rate sensitive sectors and stocks (IYR, KMX, CVNA, etc.), having peaked long ago, in 2021.

A Dangerous Game

Depending on one’s perspective, what’s going on here with interest rates, is a dangerous game of ‘chicken’.

As Uneducated Economist puts it, the Fed’s a ‘credible threat’; all they have to do is ‘talk’ and propose (i.e., threaten) to move rates and the market responds without the Fed actually doing anything.

It’s working, for now.

The Emperor Has No Clothes

The problem is, as Prechter has already shown with research done years ago, ‘the emperor has no clothes’.

The Fed does not control rates at all; it’s a follower, only doing what the bond market’s telling it to do.

For some reading this, it’s old news.

For others, it’s a shock to find out, yet another institution is not what you thought it was.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279