When The Tide Goes Out

We all know the quote attributed to Buffett:

‘When the tide goes out, that’s when you find out who’s been swimming naked’.

Or, to put it another way:

‘Everybody’s a genius in a bull market’.

Well, ladies and gentlemen, here we are.

We’re about to witness what method’s best suited to handle typical ‘price destruction’ behavior of a bear market (here and here) along with possible chaos in commodities.

That challenge also includes this site of course.

Bear Market Behavior

If we’re really entering a bear market, prices typically do not go straight down unless there’s an outright crash.

No …Bear markets are all about what’s called ‘price destruction’.

That is, price action whipsaws a near infinite number of times; getting into (a short) position for the downside or (long for) an upside squeeze is incredibly difficult.

The most recent example of this was the volatile whipsaws in 3X leveraged inverse fund, SOXS:

Swings over +/- 20%, back-to-back in days if not hours.

With that said, we’re looking at biotech XBI, to see if there’s a chance of it being ‘well-behaved’ during a decline (not advice, not a recommendation).

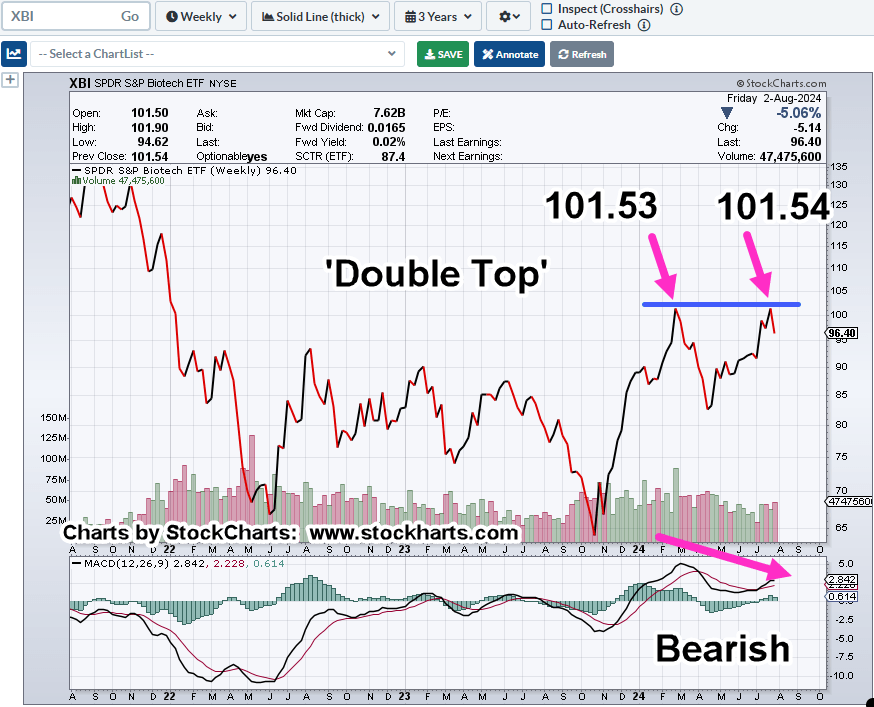

Biotech XBI, Weekly

On a weekly close basis, we’ve had a double top.

Using the MACD, it shows momentum weakened on the leg up to the second top.

Watching price action (the tape) of XBI late Friday, near the close, it gave the appearance of short covering.

Upward spikes that appeared to be labored.

If that’s true, then a lower open at the next session would be the expectation (not advice, not a recommendation).

Taking Action

As the disclaimer states, this site is ‘not certified’ by the SEC and does not, cannot provide any advice.

What it can do, is infer the actions being taken.

With that said, this update shows the ‘category’ side bar with LABD-24-16, thus inferring a short position via LABD.

That’s the firm’s identifier used for spreadsheet tracking; the 16th biotech short via LABD, for the year.

Never Too Early, To Trend

In the next update, we’ll discuss how even in the early stages of (potential) XBI reversal, we may already have a trendline.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Stop … Drop … Trend « The Danger Point®