Top of The Market

Market reversals tend to occur just before, during, or just after a holiday week.

Is that where we are now?

Semiconductors (SOXX), and it’s chief cook and bottle washer, Artificial Intelligence (NVDA), may have already decided the next direction … down.

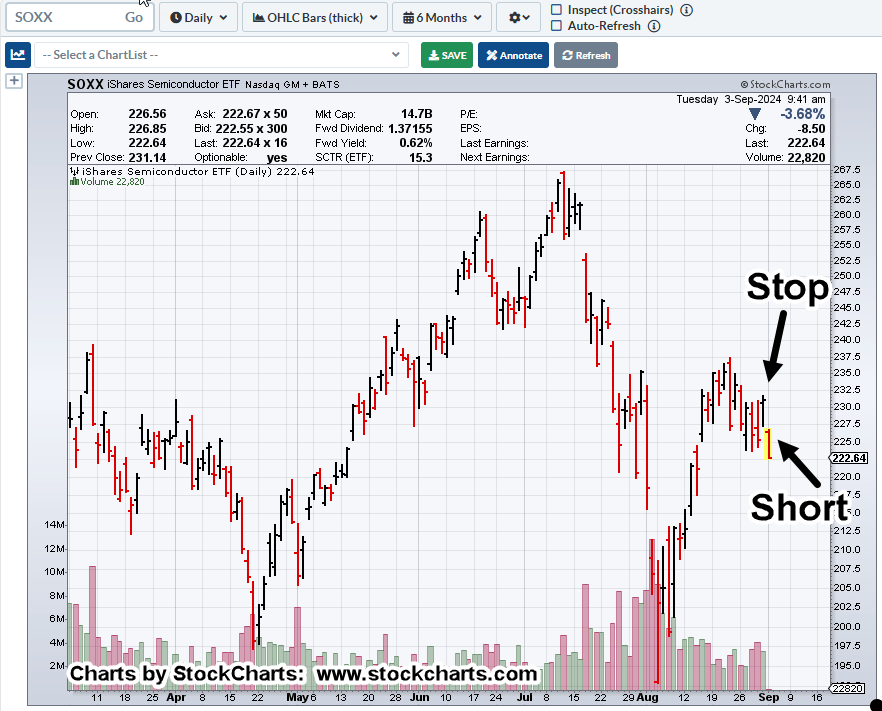

Semiconductors, SOXX, Daily

It’s just after the open and this is where we are.

“What do you see?”

Marking up the chart, we have a sell-short indicator (not advice, not a recommendation) right along with a hard stop location (as shown).

From yesterday’s update, those that watched the presentation by Robert Prechter Jr., were challenged with the idea, we’re in the largest bubble ever or at least since the 1720s South Sea Bubble (not advice, not a recommendation).

Positioning

In the sidebar, we can already see a short position was opened during last Friday’s session: SOXS-24-15 (not advice, not a recommendation).

Everyone has their own style and for me, I detest ‘chasing’ the market.

I’d rather make several attempts, get stopped out, then enter again, than watch the opportunity take off because I was too afraid to pull the trigger.

It’s only 20-minutes after the open and we can see the SOXX, is down hard.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279