More ‘Natives’ Leaving

Like Yogi Berra used to say:

“It’s deja vu all over again’.

Only this time, instead of Nvidia, it’s biotech, XBI.

Nobody’s called on our hapless student at left … no, we’re still pumping out bullish propaganda to the masses.

Anything can happen and biotech could magically levitate to new, more manic highs.

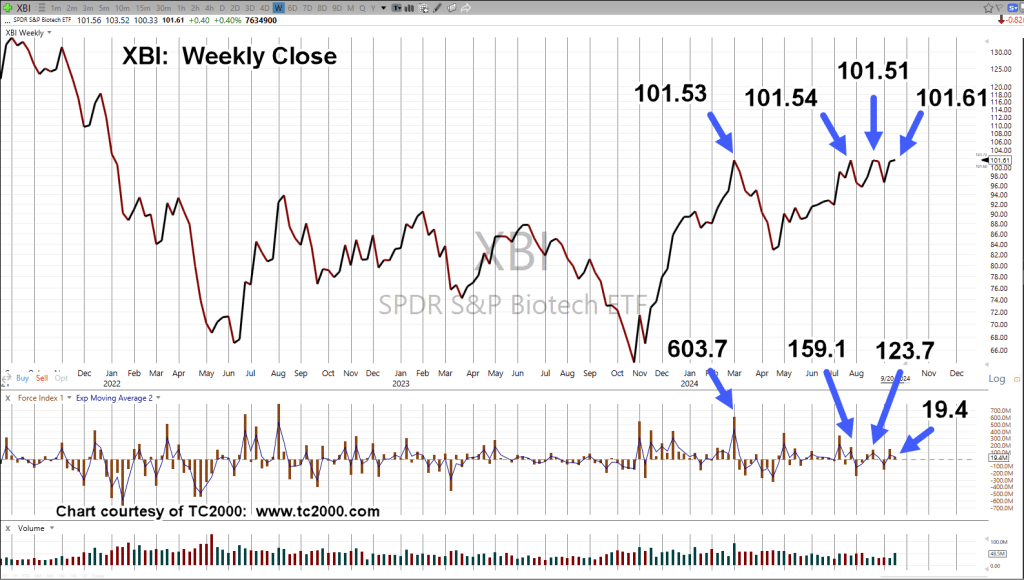

However, the chart below, paints a very sobering picture.

Biotech XBI, Weekly Close

“What do you see?”

It’s been over six months of price action posting and then attempting to penetrate (closing above) the highs of the 101.50-area.

At Resistance: Bulls Exhausted

The center panel is Elder’s Force Index.

It shows (as with NVDA) a succession of force declines with each attempt to push higher.

The last force unit (19.4) has fallen off a cliff, compared to the unit prior (123.7); Force Index down over 84%.

Price action could always grind itself higher.

However, the inference is, the bulls are exhausted (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Biotech, Fibonacci, & The Tape « The Danger Point®