Thanks Go To, Maxwell Smart

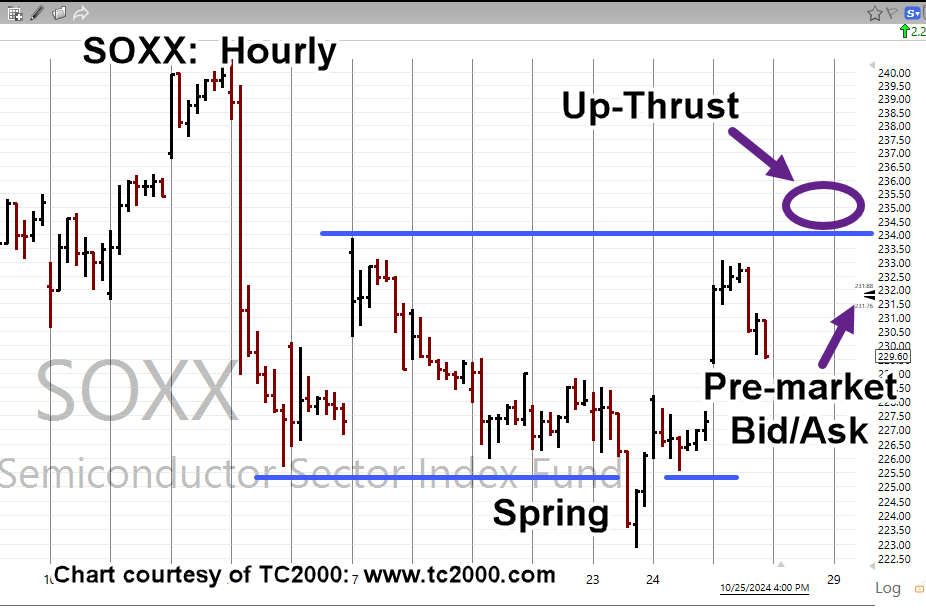

As seen in the chart below, target for the SOXX, retrace was off by just a few (trading) hours.

‘Missed it by that much‘

The attack on SOXX, resistance, near 234 – 236, held; now, there was a huge gap-lower open.

Just to restate the purpose (usefulness) of Wyckoff analysis, fundamentals had nothing to do with identifying the potential up-thrust, then reversal.

With that, let’s move on.

Semiconductors SOXX, Hourly

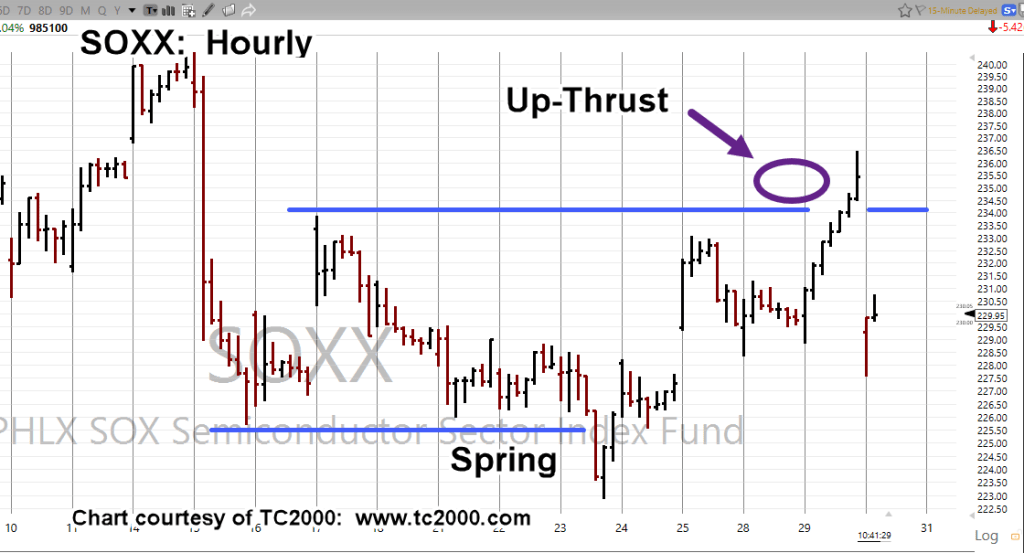

The markings in the prior update have been re-created; showing how close price action came to target(s) in both location and time.

Back then, was this:

Now, we have this:

For those who have the David Weis training CD, the above scenario was described by him (seventeen years ago), almost to the exact ‘T’.

Positioning

Following the guidance of the late master, a short has already been opened; SOXS-24-20 (not advice, not a recommendation).

Stats: SOXS entry @ 19.98, Stop @ 19.81 (or the session low), ‘risk’ is 0.17-pts (not advice, not a recommendation).

Other Trades

Early in the session, the short on IYR, trade DRV-24-06, was closed right at the stop; loss was 0.34-pts. (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Carvana’s (final) Squeeze « The Danger Point®