Hours Away

We’re just hours away from the Sunday futures open.

Yesterday, military attacks on Houthi rebels have commenced; links here, here, and here.

Middle East conflict escalates.

The question is, will the markets see it that way?

Will it be ‘escalation’, with gold futures ever higher, or is it ‘buy the rumor, sell the news’?

If we’re looking at potential gold/silver related downside, then let’s review the miners; they’ve been in a bear market for nearly five years (not advice, not a recommendation).

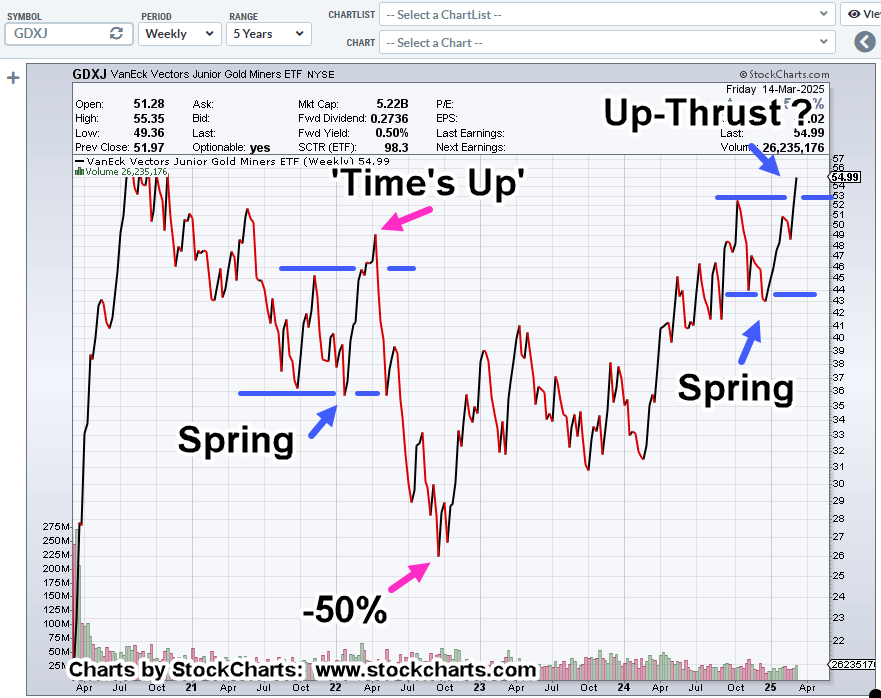

Junior Miners, GDXJ, Weekly Close

Before getting to the right side of the chart, let’s start with the ‘Time’s Up’, arrow; a reversal and decline over 50%.

That ‘arrow’ corresponds to this post.

At this point, gold and the miners appear to be stretched with silver currently in non-confirmation.

If it was really (simple) inflation, it would be like the 1980s, with both moving in tandem.

Then & Now

With that, what has GDXJ, done in the past?

The chart itself shows us it tends to exhibit a repeating pattern of Wyckoff ‘spring-to-up-thrust’.

We may know within hours if gold, silver, and the miners, are going to reverse or launch into some kind of extended rally (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279