Unraveling, By-The-Day

Well, pretty much everything is unraveling, so in a sense biotech’s no different.

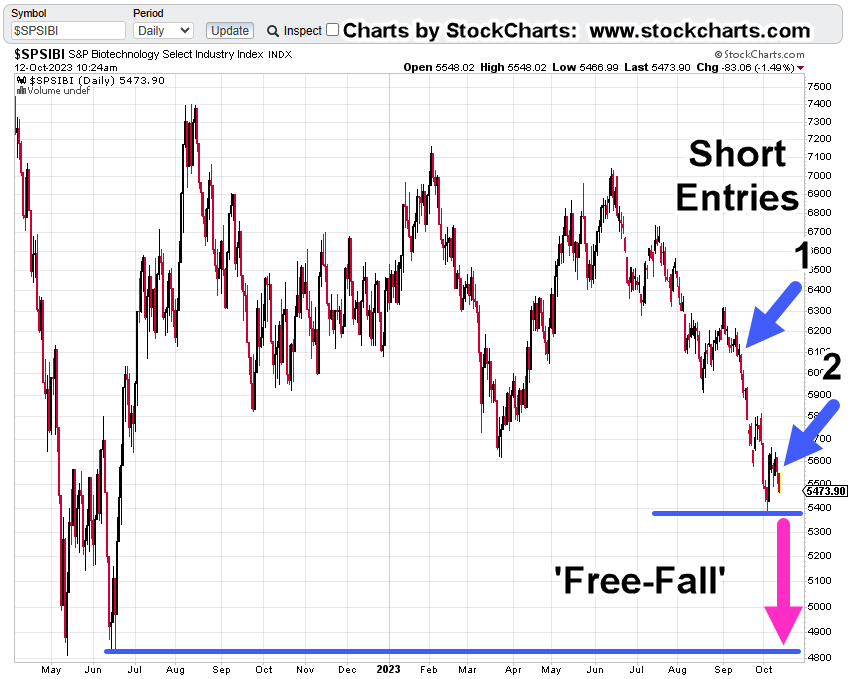

However, this sector (SPBIO, $SPSIBI), is the weakest of all the major indices (from 2020 – 2022, highs), down approx. 62%.

We’ll get to the ‘history repeats’ part farther down but first a reminder, this site’s about Strategy, Tactics, and Focus, i.e., Livermore, Wyckoff, and Loeb.

It looks like we’re already in a full-blown economic, societal (population) collapse, i.e., Strategy.

Biotech appears to be the weakest sector, i.e., Tactics.

The (shorting) action is on that sector exclusively, i.e., Focus.

Not advice, not a recommendation.

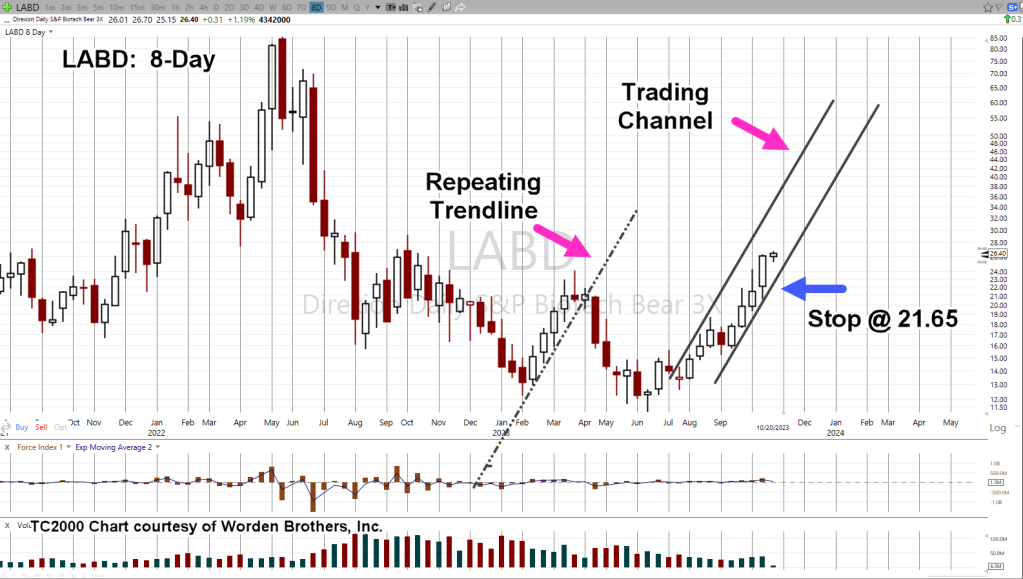

Biotech Leveraged Inverse LABD, 8-Day

Since the Fibonacci 8-Day chart was used for the update on gold, GLD, we’ll use it for this post.

All trendlines shown on the chart are exactly parallel.

The market itself has presented a tendency to trend at the rate shown in the ‘Trading Channel’.

It’s happened before; identified as ‘Repeating Trendline’.

Positioning

This series of short trades on SPBIO, opened via LABD, and identified as LABD-23-10, LABD-23-11, are fully documented here, here, here, here, here, here, here, here and here.

From a Wyckoff perspective, the market itself is telling us to ‘do nothing’, maintain the trade unless stopped out (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279