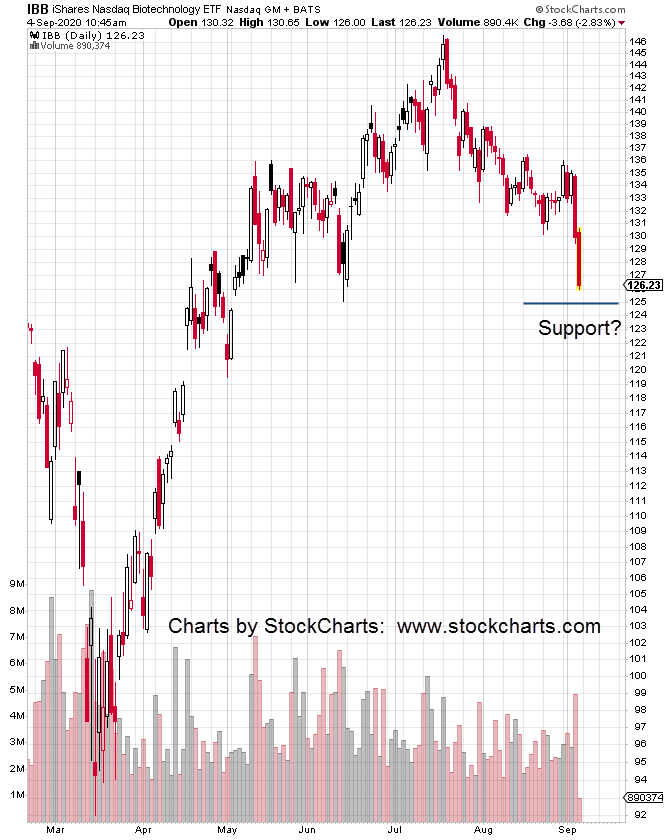

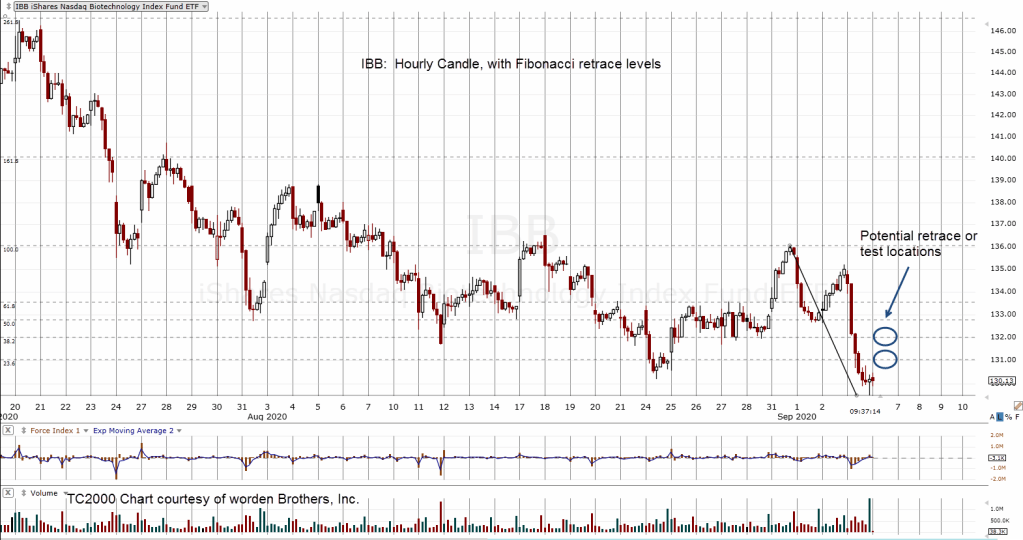

Just before the all-time high in biotech (IBB), several screen shots of price-bar action were obtained.

Pasting it all together in an old-time flip-book format, we see the daily action of IBB over the past two months.

There’s no bonafide indicator that a top was imminent other than increased daily volume at the pivot.

That increased volume was a subtle clue more volume was not resulting in upward movement.

The next day, price action stalled and reversed.

The result is obvious but below the radar. IBB has not declined significantly enough, fast enough to draw outright attention.

This is precisely (not advice, not a recommendation) the area where Three Ten Trading established its short position.

In fact, as detailed in this update, the entire short position was exited and then re-established during this two-month long reversal.

The short position (via BIS) is now well in the green but ready to be exited at the first sign of trouble … all the while expecting further IBB downside ahead.

TC2000 Charts courtesy of Worden Brothers, Inc.

For those working the biotech sector, it doesn’t matter. Price action will decide.

For those working the biotech sector, it doesn’t matter. Price action will decide.