Just Part of The Story

I once had an Uncle tell me:

“Percentages are for liars”

There may be doubters, haters, even money managers reading this and thinking that as well.

So, we’re going to get into it.

We’ll address the ‘liar’ claim, present the current state of biotech along with partial exit of the short position (not advice, not a recommendation).

Fundamentals: The Rats Scramble

Anyone with two-boosters rubbing together can see the rats scrambling; attempting to ‘normalize’ the abnormal.

For example, it’s now ‘standard procedure‘, after a Pilot’s ‘incapacitated’ (i.e., potentially drops dead) in the cockpit to roam about the cabin and ask if there’s anyone else available to fly the plane.

You can’t make this up. Nothing to see here.

Now, on to the charts.

First: Let’s Review

The chart re-printed below, is how it looked this past February 9th, as presented in this post. Recall, the actual reversal was identified to-the-day, in this post.

To go even a bit further, the Wyckoff penetration set-up was identified a day earlier, in this post.

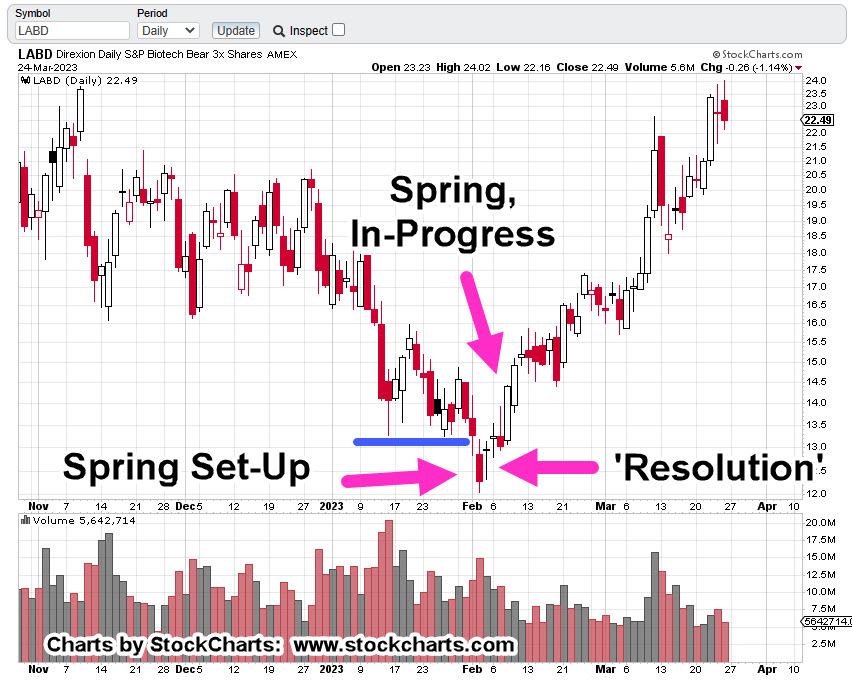

SPBIO Leveraged Inverse LABD, Daily

Re-printed from February 9th.

Fast forward to now. This is how it looked on Friday.

From the chart above, the reversal is well underway.

Momentum has slowed a bit, hence the reason for the position to be reduced by about 13%.

If the decision to partial-exit was wrong and LABD heads immediately higher, there’s still a sizable position open.

If LABD spends the next several days contracting lower (as anticipated), there may be an opportunity to re-acquire the exited position at a lower level (not advice, not a recommendation).

The next chart shows the current trading channel.

It won’t take much sideways to down action to contact the right side. If or when that happens, we’ll see how price action behaves.

Where’s The Lie?

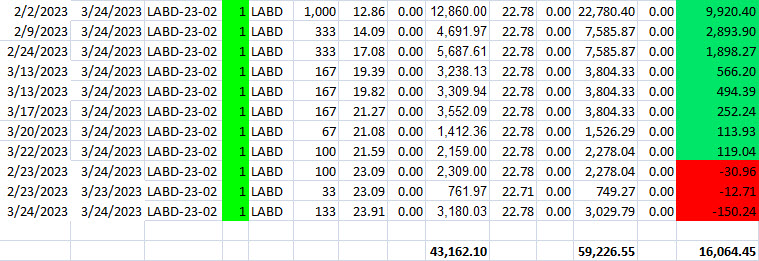

The spreadsheet below, is a modified version of what’s used by my firm. Note, it’s not the actual shares traded but a representation of that action.

The chart has been simplified with the initial entry (of this series) adjusted to 1,000 shares. Subsequent entries are adjusted by the same factor as the initial entry.

For the engineers, the data has been ‘normalized‘.

Working the numbers; we have $43,162.10 initial cost, $59,226.55 at the exit, yielding $16,064.45, which is just over a +37%, gain.

If there’s a lie in all of the above data, the analysis identifying the set-up, the reversal and subsequent trading actions with partial exit, I’m not sure where it is. 🙂

Note: The two left-most rows of ‘zeros’ in the chart are for commission charges. The spreadsheet was developed way back in the day when we had such things.

The right-most row of ‘zeros’ is open profit/loss.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Market ‘Blow-Up’ … Already Here « The Danger Point®

Pingback: Biotech … Train Keeps Rollin’ « The Danger Point®