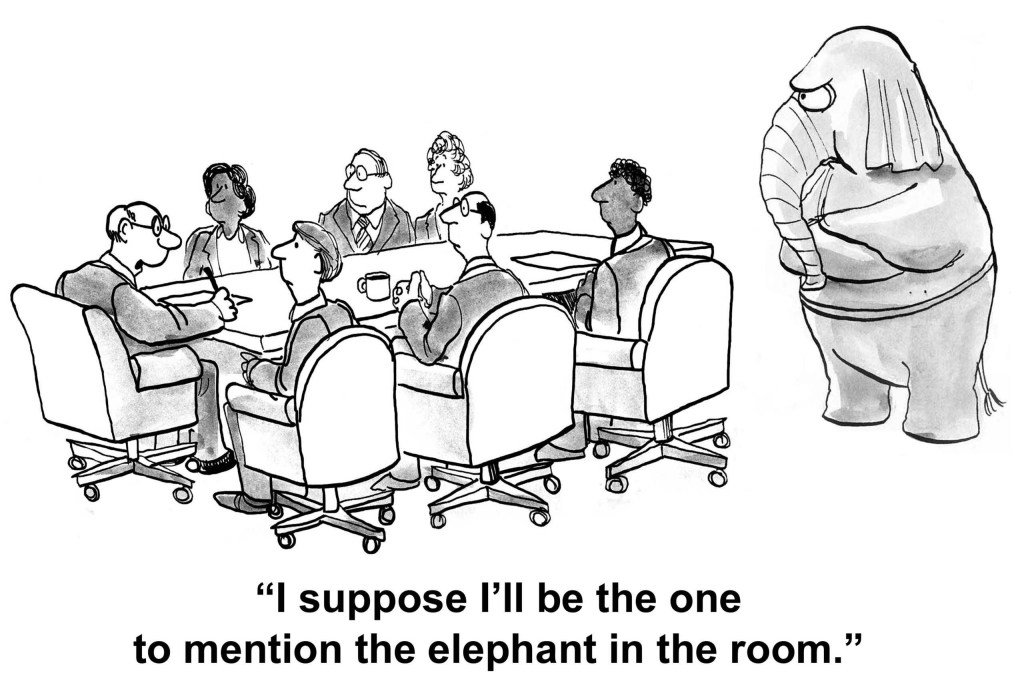

Did You See The ‘Elephant’ ?

It’s hidden in plain sight.

Taiwan Semi (TSM) releases lackluster results, revenue slowdown and new building construction delays.

TSM says the delays stem from the inability to find qualified workers.

Edward Dowd provides insight on the overall reduction of employees, in this interview (Time stamp 5:10).

Bull Trap Shut, Train Leaving Station

If there ever was a ‘gotcha’ moment, this is it.

Even while the mainstream continues to tout the hype, here, here and here, the market has reversed (not advice, not a recommendation).

The daily chart of SOXX, has the MACD bearish divergence confirmed. Price action is now (as of 3:05 p.m., EST) well below the breakout (blue line) resistance area.

Semiconductor SOXX, Daily

This site does not give advice, but it can be inferred by reading the reports what actions are being executed (not advice, not a recommendation).

With that said, short positions in the SOXX, via leveraged inverse SOXS, were entered early during yesterday’s session at SOXS 8.54 and SOXS 8.69.

As a side note, within minutes after today’s market open, the gain in the SOXS, fully erased the -7.9% loss via LABD, noted in yesterday’s update.

The Biotech ‘Bid’

For whatever reason, probably to be revealed months or years from now, biotech, the instigator of the ‘elephant’ is not selling off into a market collapse as expected.

Instead, the effects are being played out in low-margin industries like airlines and semiconductors.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279