Downside Pressure

When price action’s at The Danger Point®, it doesn’t take much to stop-out a trade.

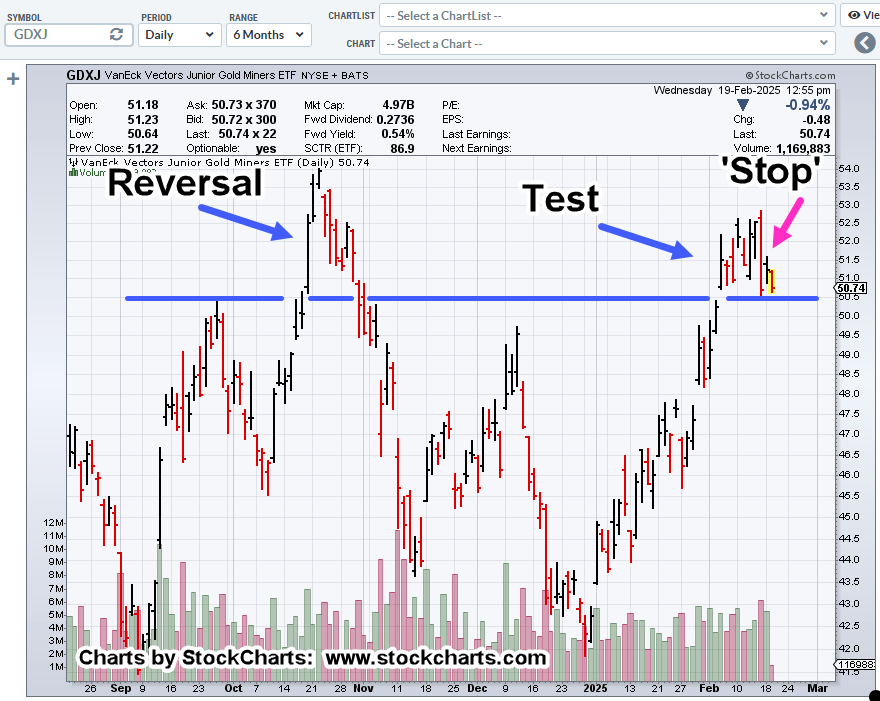

That’s where GDX, GDXJ, are now (not advice, not a recommendation).

The prior update said to watch what happens during a potential upside retrace.

With GDXJ, so far, that retrace is weak; as of this post (1:30 p.m., EST), now printing lower but still above support.

Junior Miners GDXJ, Daily

For a short position (using JDST), we have a tight stop (not advice, not a recommendation).

The bounce off support discussed in the prior update did not go far before reversing lower … where we are now.

One has to realize we’re back to the pundits screaming ‘hyperinflation’ as was the case over four years ago.

Gold (GLD) may indeed move on to higher prices.

However, for whatever reason, the mining sector continues its multi-year non-confirmation (not advice, not a recommendation).

Positions

Short entry on GDXJ via JDST as trade JDST-25-01, with stop at yesterday’s session low (not advice, not a recommendation).

Separately: The short in the SOXX via SOXS, has been closed.

If price action continues to exhibit buoyancy, if NVDA posts a new daily high (this week), it’s possible, as incredible as it may sound, NVDA may go on to new all-time highs (not advice, to a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Nvidia … Two … Days … Later « The Danger Point®

Pingback: Gold Miners … Something’s Wrong « The Danger Point®