… And ‘Dollar Debasement’

‘When the trade gets a name, it’s over’. Ed Dowd

His assessment on the ‘dollar debasement’ trade, comments on gold, can be found here.

Gold dropped -50%, during the last melt-down, ’07 – ’08; it could do the same again (not advice, not a recommendation).

With that, we’re looking at gold (GLD) from a strategic standpoint.

Meaning, it’s a long-term bull market, but where a sustained ‘correction’ may be at hand.

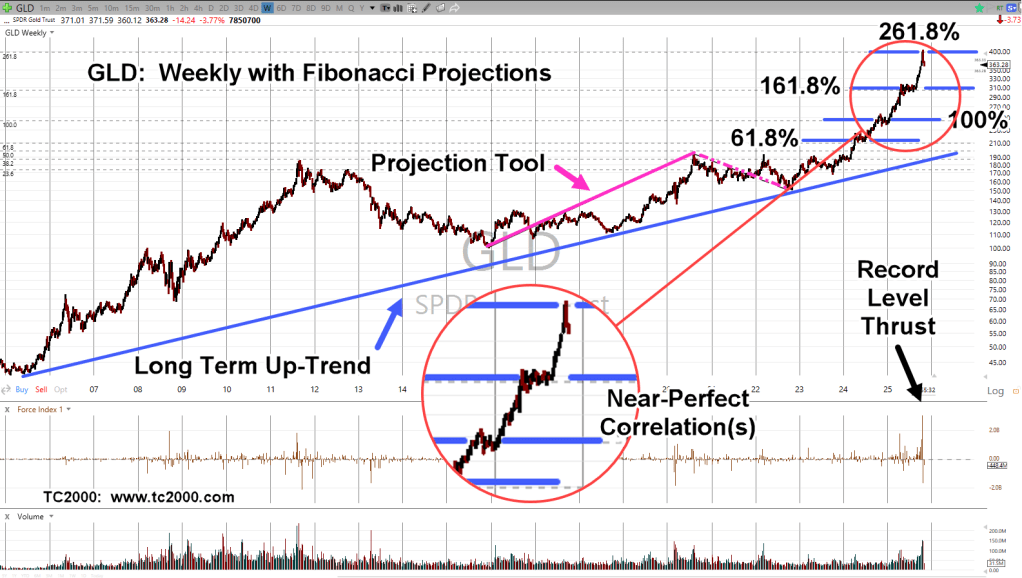

Gold GLD, Weekly

The trendline goes all the way back to the beginning of the GLD, fund.

Note the largest ever Force Index. Past similar actions either resulted in a sideways move, or reversal.

The Fibonacci projection tool, highlighted in magenta.

The projection levels are shown as blue lines. It’s clear, GLD is ‘respecting’ the levels.

A gold, GLD drop of 50% (from the 403.30, high), would put it at 201.65 (not advice, not a recommendation).

Margin Debt Increases

First, it was $1 Trillion.

Now, it’s $1.13 Trillion; discussed here.

While everyone’s looking for A.I. to burst (including this site), maybe the precious metals are going first.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Gold Struggles to Close Gap « The Danger Point®