Did The ‘Shorts’ Give Up?

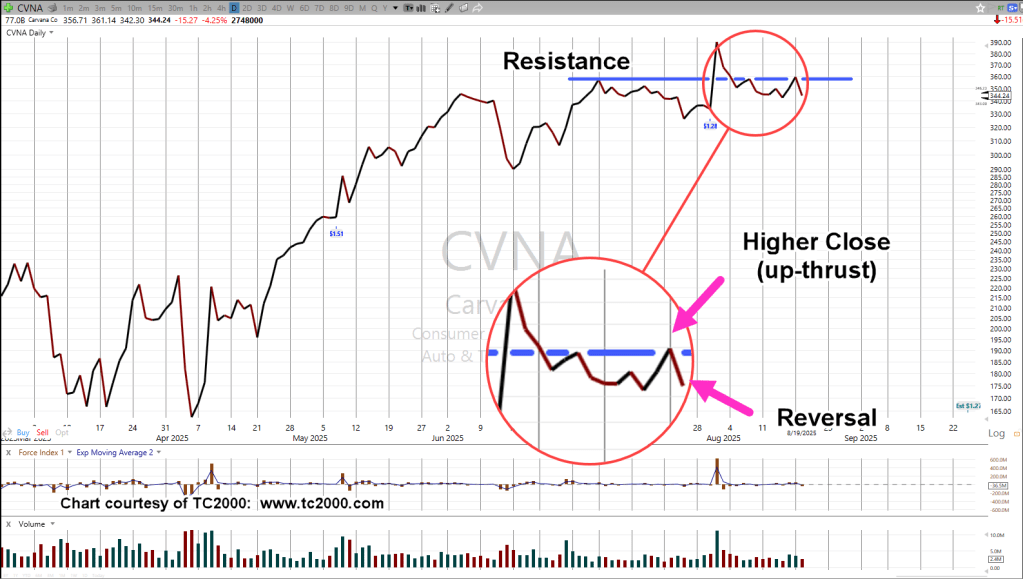

Just as Carvana appears poised for a significant move lower, short interest has actually decreased, substantially.

According to data at this link, short interest has declined over -15%, from the previous month to just 5.6% of shares outstanding.

After relentless buoyancy for years, the shorts may have given up just as CVNA, could be poised for the downside (not advice, not a recommendation).

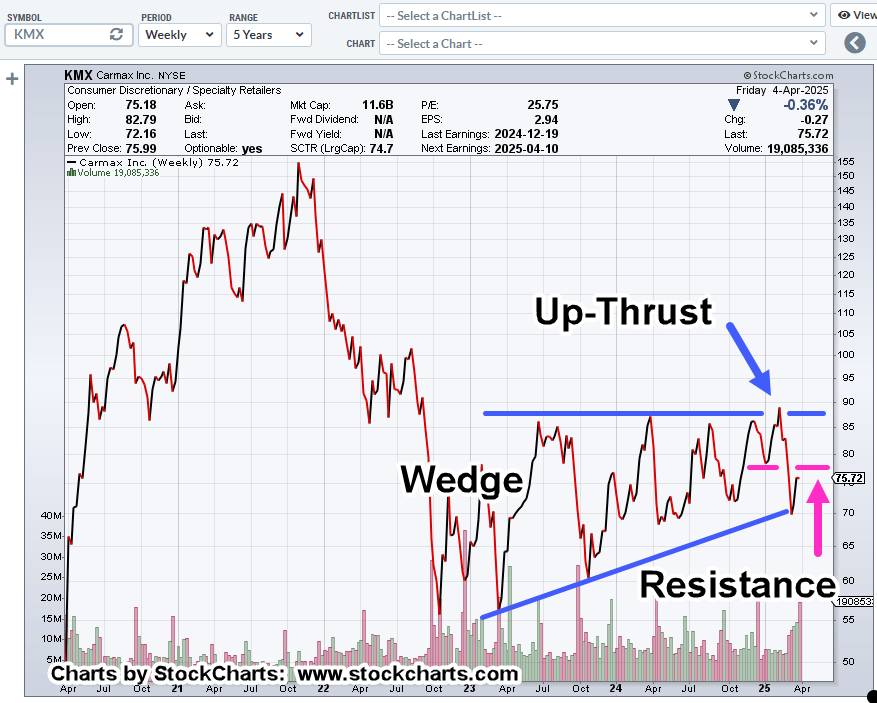

Let’s not forget, rival CarMax has completely imploded (fired the CEO); down -79.25% as of last Friday’s close.

While we’re at it, the all-time high for CVNA, was July 31st, at 413.33, just another ‘coincidence’.

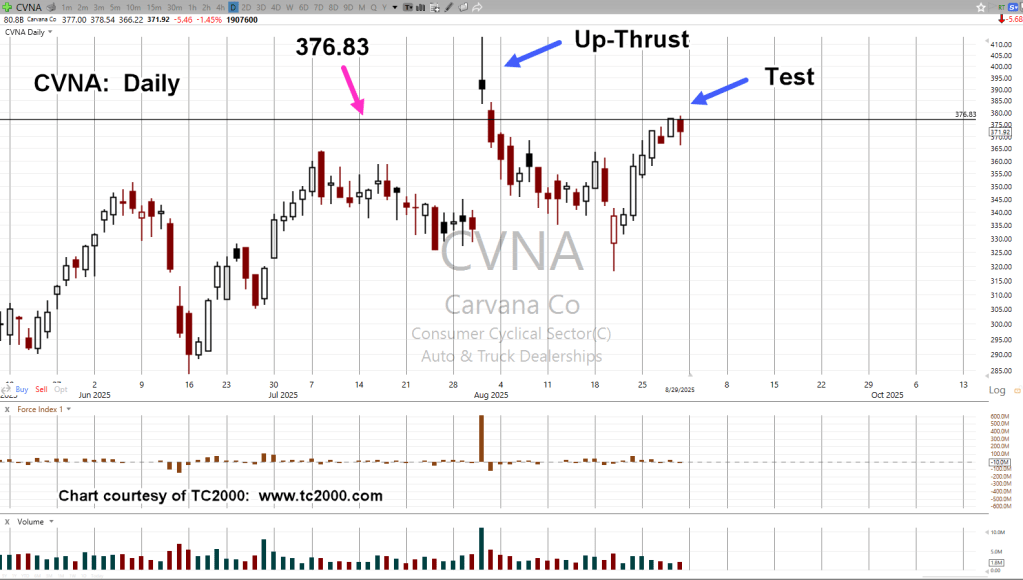

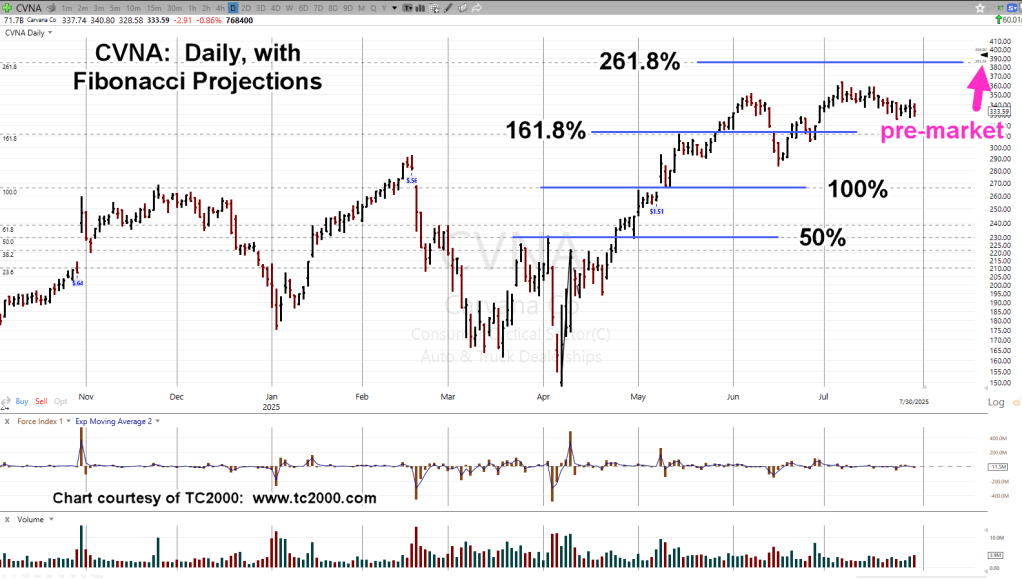

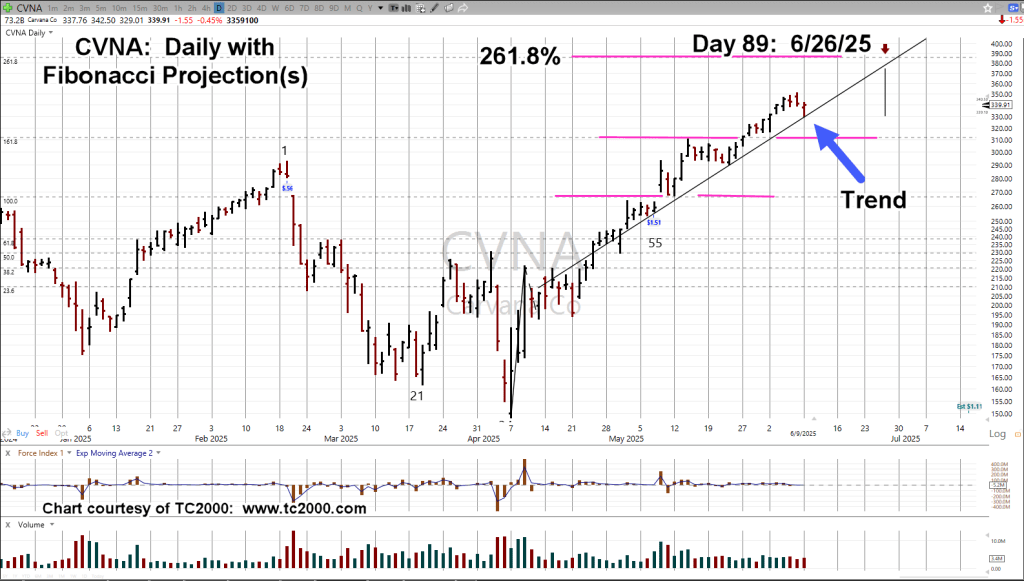

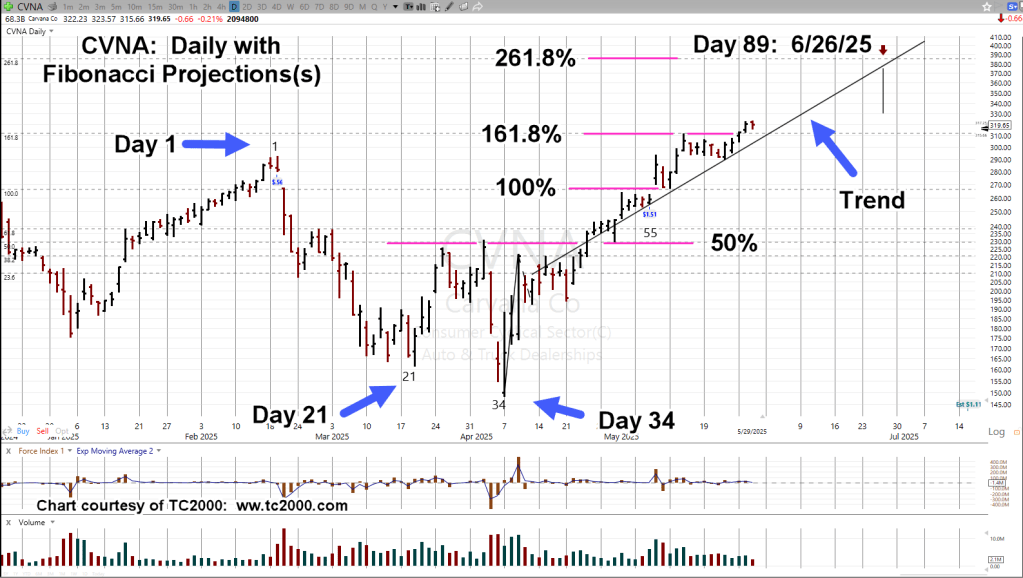

Carvana CVNA, Daily Close

As of last Friday, we’re at the axis line of support and resistance.

Volume declined when compared to the previous session, suggesting there’s not much commitment to the upside (not advice, not a recommendation).

Trading Results

Meanwhile, using the volatility, Carvana is being traded to the short-side.

There’s no ‘positioning’ as yet (the desired action), but nonetheless, swings are being used for respectable profit.

The last completed trade, CVNA-25-15, went short at 308.48, last Thursday; covered the next day at 289.25, for a modest gain of 6.7%.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279