Watch The Tape

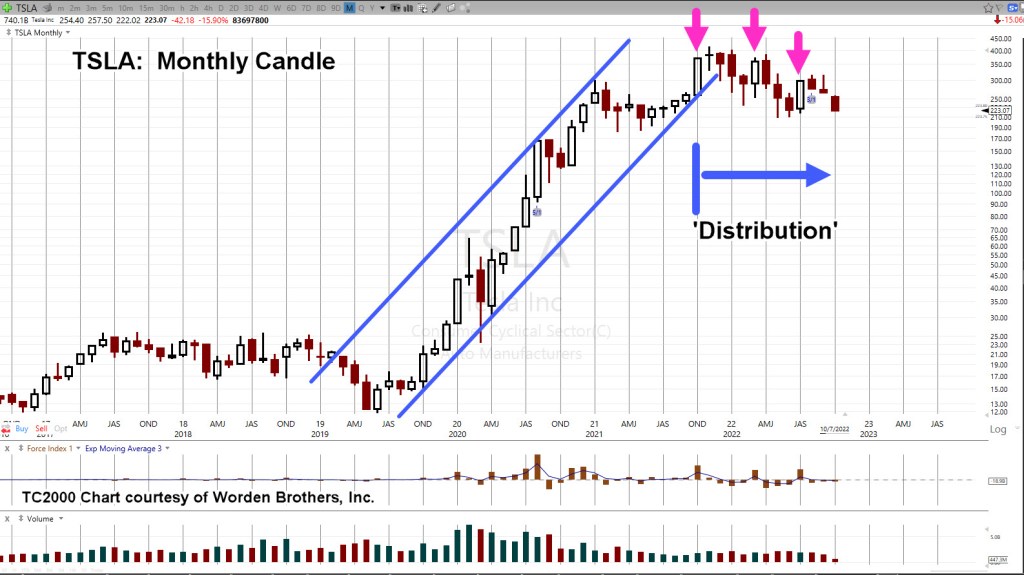

Two-year uptrend, broken.

A year’s-worth of ‘distribution’ from strong hands to weak.

Ten days from now is the next TSLA, earnings release.

With TSLA, price action approaching The Danger Point®, that earnings release is likely to be a catalyst.

The monthly chart has the trendline (and channel) break along with the distribution phase.

Tesla TSLA, Monthly

Note, each thrust attempt higher (magenta arrows) has subsequently failed.

Thrusts following the first one, are at lower levels.

The weekly chart below, shows what we’re looking for; penetration of support to potentially set up a short-trade (not advice, not a recommendation).

Tesla TSLA, Weekly

When or if that penetration takes place, depending on the depth of the thrust, we’ll have a Wyckoff spring set up … that ultimately is expected to fail.

Ways To Trade

As if on cue and possibly in anticipation of TSLA fireworks, there’s a long and short ETF, for just this ticker.

Released just months ago; TSLS, a 1X inverse (bear) TSLA. The bull side has 1.5X leverage with TSLL.

TSLS, has a 100% maintenance requirement and TSLL, has the same.

Or, one can short directly.

There’s no dividend and the broker used by my firm shows TSLA, has no borrowing restrictions other than a 40% maintenance requirement (not advice, not a recommendation).

Then, there are options … we’ll discuss those if some kind of high probability opportunity presents itself.

The Masses

Let’s not forget the herd. What are they doing/saying?

With that in mind, a random check of our favorite holding pen, SeekingAlpha, has oodles of TLSA analysis.

The most recent is actually quite good from a thoroughness perspective. It admits/discusses the downward pressures and identifies the support/resistance levels discussed above.

The problem is the mass psychosis.

It’s the ‘EVs are the way’ mantra as if Bhagwan Shree Rajneesh himself, was communicating directly.

With the winter carnage in Europe just weeks away, we’re about to find out how green ‘electrics’ hold up when there is, well, no electricity.

Back to Biotech

While all of the above is transpiring, the real Black Swan continues to emerge; the latest here, here and here.

This event is happening now; the effects of which will last our lifetimes.

It’s massive and world-wide; likely to override any mainstream (traditional 60/40, type) analysis.

After letting go of the biotech short for the seventh time, two days later, this past Friday, it decides to reverse.

We’ll cover that in the next update.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279