Right At The Pivot

That’s the way it looks at this point as we’ll see below.

The ZeroHedge article in question, is linked here.

You can see, it starts off (before being grey-ed out) with referencing the Non-Farm Payrolls report; a report, that another article calls ‘rigged’. So, there’s that.

With each passing day, it’s ever more apparent, price action itself, is telling us the most probable market direction.

Just to prove the point, Blackstone’s sending out a ‘talking points‘ memo to keep clients calm and help ‘guide the conversation’ … i.e., ‘thought shaping’.

Thoughts ‘shaped’ or take action.

For this update, we’re taking action; looking at what the real estate market is telling us.

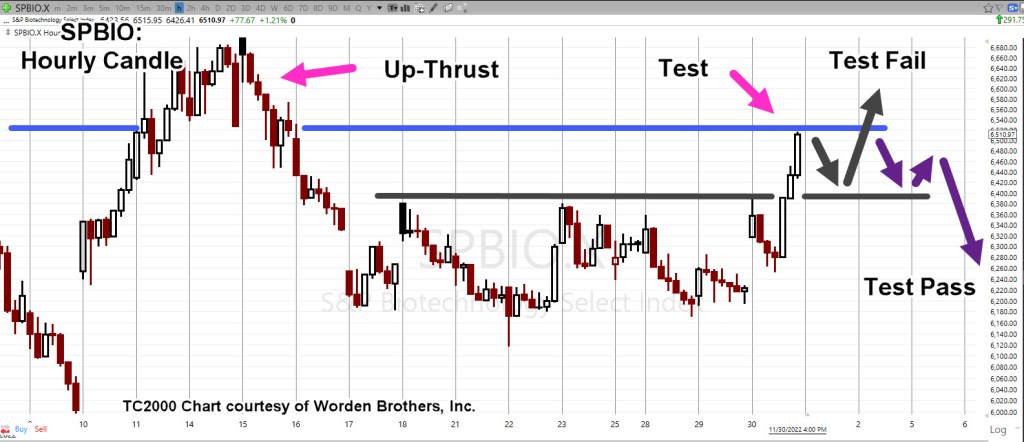

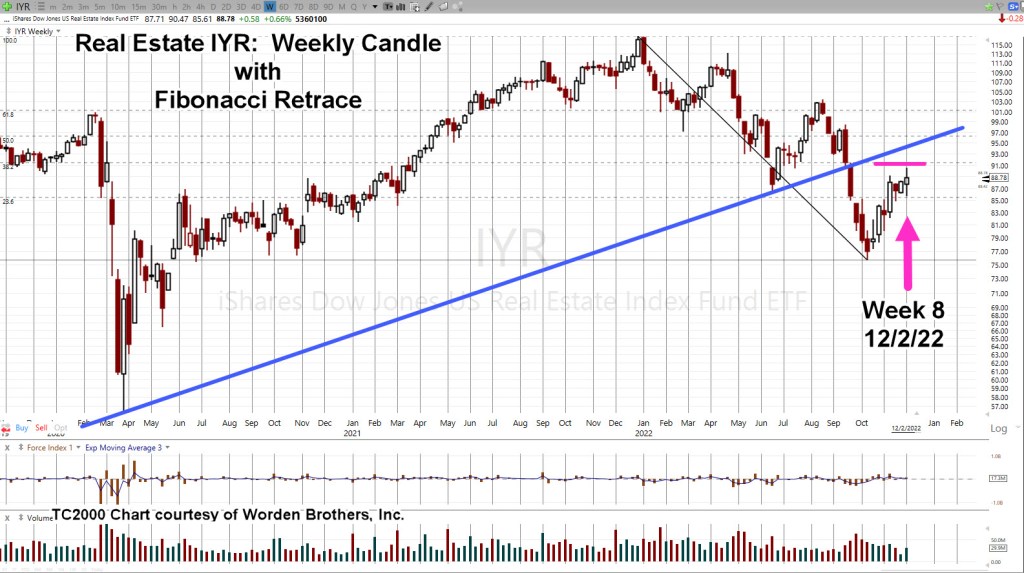

Real Estate IYR, Weekly

Let’s go back to the IYR, update from late October.

It showed the most probable direction; a move higher into a test, giving both the location, and the date.

Fast forward, to now:

We’re right at 38.2%, retrace and on time with Fibonacci Week-8, from the lows.

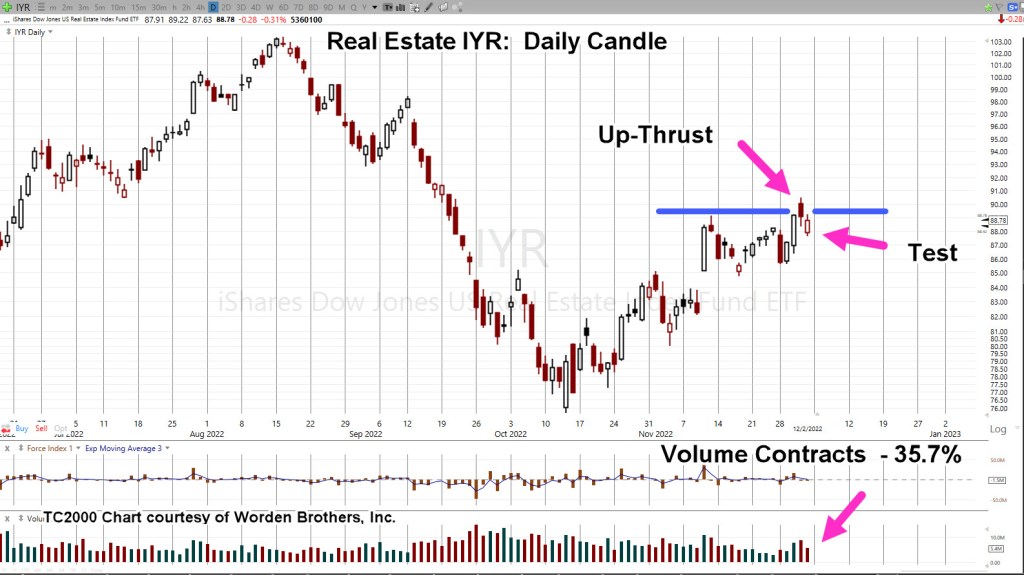

The daily chart shows a possible up-thrust (reversal) and test … the very same day that Goldman ‘gives-up’.

Real Estate IYR, Daily

Not shown on the daily; from the lows, October 13th, to the (print) high, December 1st, is a Fibonacci 34 (+1) Days.

Volume increased on the reversal bar December 1st, and then contracted on the upward test the next day … pointing probabilities to the downside.

Printing a new daily low at the next session, will help confirm the reversal.

Summary

Let’s see what happens next.

The Goldman report may be contrary indicator; telling us the ‘professionals’ are throwing in the towel, changing their approach right at a potential top.

Positioning

Not advice, not a recommendation.

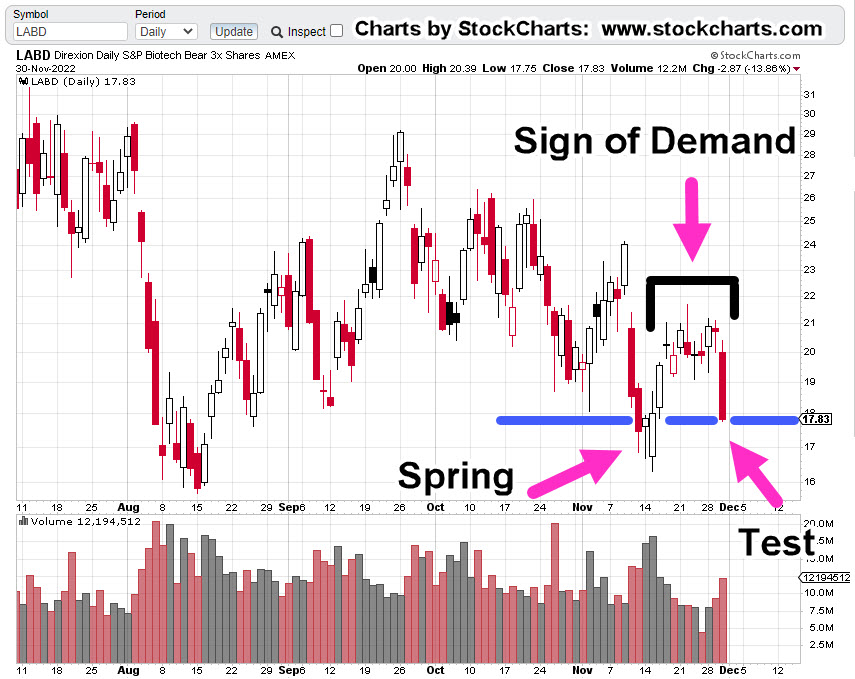

LABD-22-13: Closed

It’s become apparent from this article; the truth, that was counted on as a tail-wind (for a short position) is not going to come out anytime soon.

Those that know, already know.

Moving on to other markets (below) that will be affected by the consequences of biotech.

DRV-22-06:

Short real estate IYR, via DRV (not advice, not recommendation)

Entry @ 48.39***: Soft Stop @ 47.53***, Hard Stop @ 45.11***

Note: Positions may be increased, decreased, entered, or exited at any time.

***, Indicates change

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279