Right Out of Naso’s Playbook

‘Think like a criminal’, is one piece of advice from trading legend Richie Naso.

He also describes the algorithms as not caring about profit or loss, but ‘liquidity’ and ‘volatility’.

This morning’s session had plenty of both.

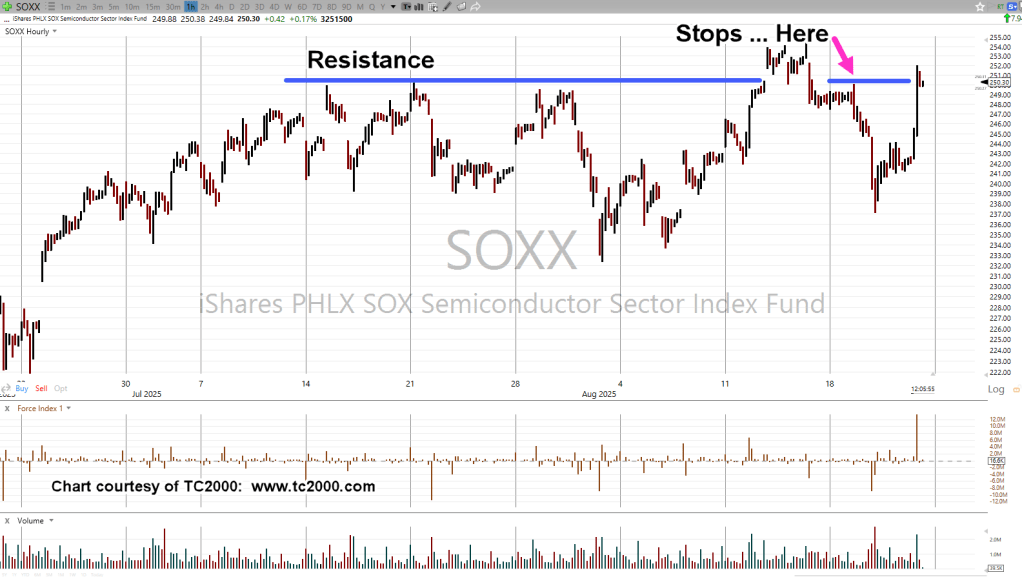

Looking at SOXX price action, launching higher on the Fed speech, it’s clear what the algorithms were attempting.

That is, hit the stops hiding at ‘technical areas’, as Naso calls them.

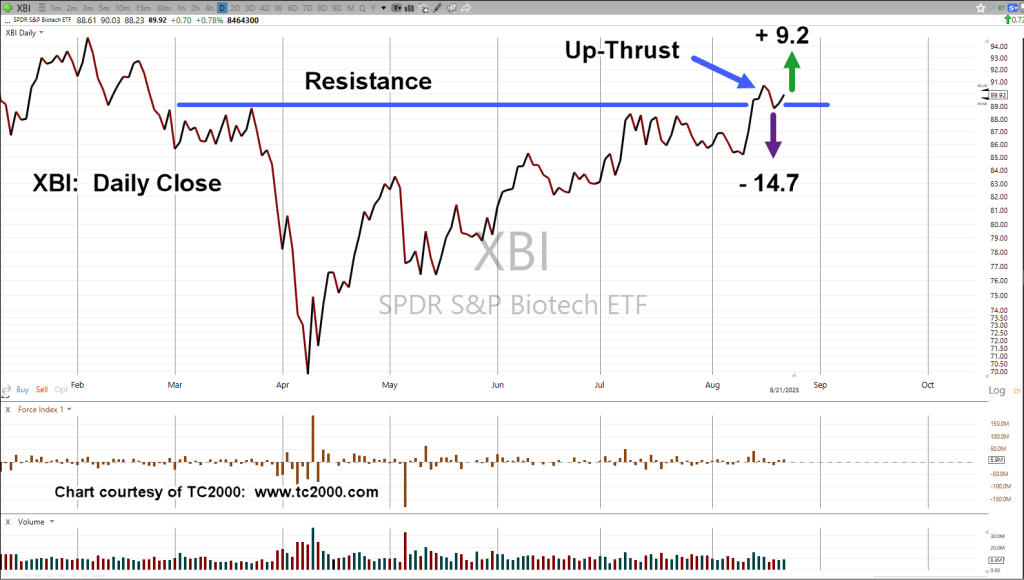

Semiconductors SOXX, Hourly

Price action went to where stops were hiding or where the inexperienced traders panicked.

Under such conditions, what’s the appropriate action?

Sell, or sell short (not advice, not a recommendation).

From this site’s perspective that’s exactly what happened.

Currently short the SOXX, as trade SOXX-25-12, with the stop at (or to be) the session high.

Which One to Pick?

As the last update said, the stop on biotech XBI-25-02, was at the August 18th high. Obviously that position was stopped out.

The question is, why not re-enter again short?

The answer: XBI made new daily highs where the SOXX did not. SOXX did not print above its high set on August 14th.

Therefore, at this juncture, SOXX is posting more relative weakness than XBI.

The market itself directs the trading action.

Revisiting August 1987

One last thought: August 25th, 1987, was the date of the all-time highs back then. 🙂

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279