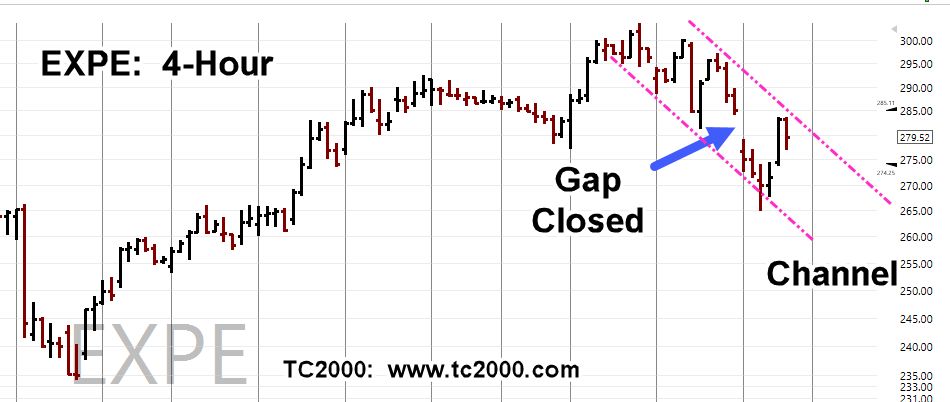

Trading Channel

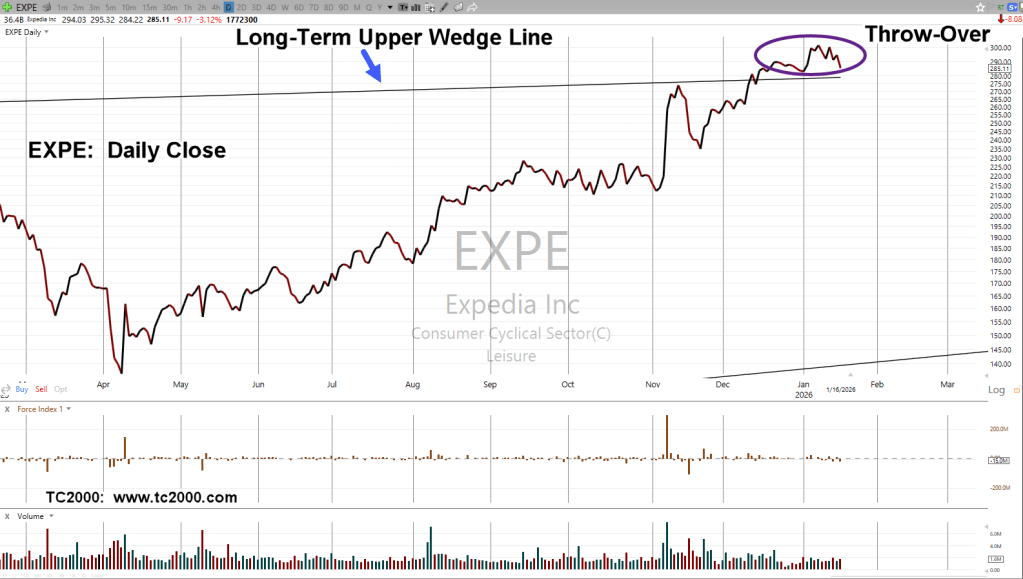

Prior updates for Expedia are here, here and here.

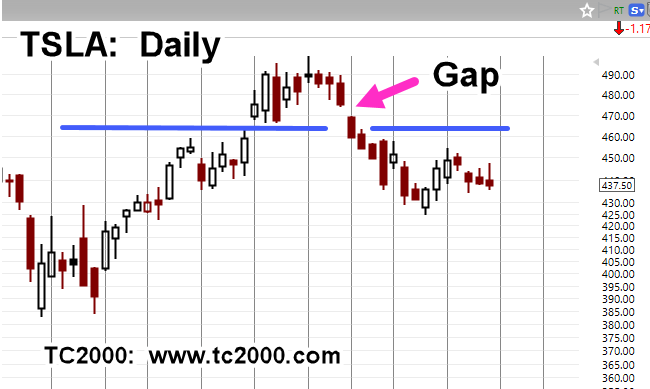

At left, we see today’s action closed the gap and then began a potential reversal (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279